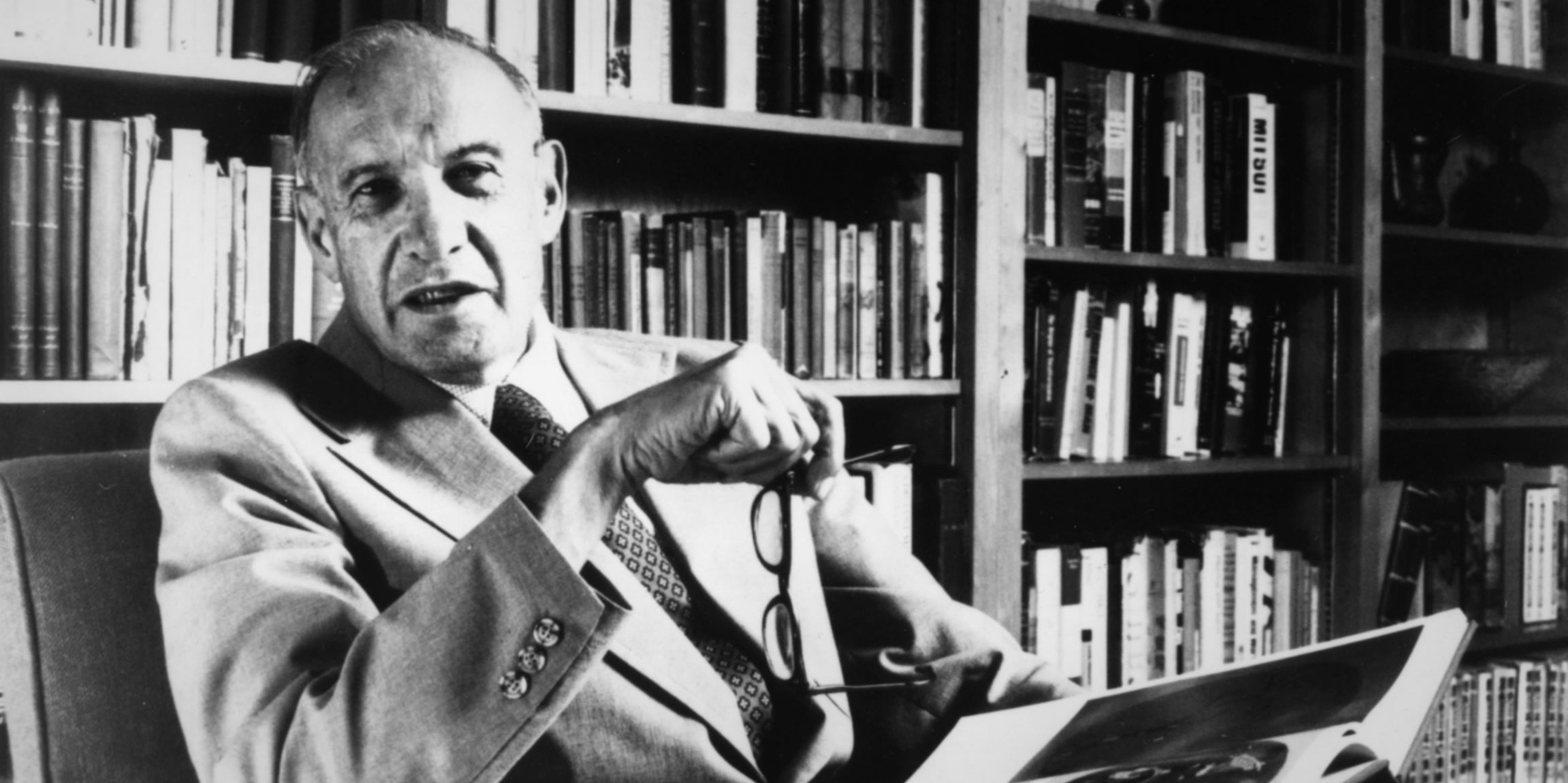

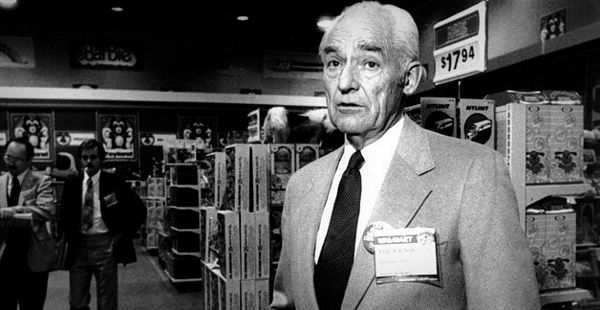

Famed management guru Peter Ferdinand Drucker spent his life contemplating and writing about how business interests, politics, and human nature interact at companies, non-profits, and governments all over the world. His consultations had an almost legendary reputation in business circles.

Peter Drucker wrote influential works about management since the 1940s. He has written about 30 books, and from 1975 to 1995 he was an editorial columnist for the Wall Street Journal.

Books by Peter F. Drucker

“The End of Economic Man” (1939)

The End of Economic Man is Drucker’s first full-length book. It is a diagnostic study of the totalitarian state and the first book to study the origins of totalitarianism. He describes the reasons for the rise of fascism and the failures of established institutions that led to its emergence. Drucker develops an understanding of the dynamics of the totalitarian society and helps us to understand the causes of totalitarianism in order to prevent such a catastrophe in the future. Developing social, religious, economic, and political institutions that function effectively will prevent the emergence of circumstances that frequently encourage the totalitarian state.

The End of Economic Man is Drucker’s first full-length book. It is a diagnostic study of the totalitarian state and the first book to study the origins of totalitarianism. He describes the reasons for the rise of fascism and the failures of established institutions that led to its emergence. Drucker develops an understanding of the dynamics of the totalitarian society and helps us to understand the causes of totalitarianism in order to prevent such a catastrophe in the future. Developing social, religious, economic, and political institutions that function effectively will prevent the emergence of circumstances that frequently encourage the totalitarian state.

Buy “The End of Economic Man” by Peter Drucker

“The Future of Industrial Man” (1942)

Drucker describes the requirements for a functioning society by developing a social theory of society in general and of the industrial society in particular. In The Future of Industrial Man, Peter Drucker presents the requirements for any society for it to be both legitimate and functioning. Such a society must give status and function to the individual. The book addresses the question: “How can individual freedom are preserved in an industrial society in light of the dominance of managerial power and the corporation?” Written before the entrance of the U.S. into World War II, it is optimistic about post-World War II Europe and reaffirms its hopes and values through a time of despair. The book dared to ask, “What do we hope for the postwar world?”

Drucker describes the requirements for a functioning society by developing a social theory of society in general and of the industrial society in particular. In The Future of Industrial Man, Peter Drucker presents the requirements for any society for it to be both legitimate and functioning. Such a society must give status and function to the individual. The book addresses the question: “How can individual freedom are preserved in an industrial society in light of the dominance of managerial power and the corporation?” Written before the entrance of the U.S. into World War II, it is optimistic about post-World War II Europe and reaffirms its hopes and values through a time of despair. The book dared to ask, “What do we hope for the postwar world?”

Buy “The Future of Industrial Man” by Peter Drucker

“Concept of the Corporation” (1946)

This classic book is the first to describe and analyze the structure, policies, and practices of a large corporation, General Motors. The book looks upon a “business” as an “organization,” that is, as a social structure that brings together human beings in order to satisfy economic needs and the wants of a community. It establishes the “organization” as a distinct entity, and management of an organization as a legitimate subject of inquiry. The book represents a link between Drucker’s first two books on society and his subsequent writings on management. Detailed information is provided regarding such management practices as decentralization, pricing, and the roles of profits and of labor unions. Drucker looks at General Motors’ managerial organization and attempts to understand what makes the company work so effectively. Certain questions are addressed, such as: “What are the company’s core principles, and how do they contribute to the success of the organization?” The principles of organization and management at General Motors described in this book became models for organizations worldwide. The book addresses issues that go beyond the borders of the business corporation, and considers the “corporate state” itself.

This classic book is the first to describe and analyze the structure, policies, and practices of a large corporation, General Motors. The book looks upon a “business” as an “organization,” that is, as a social structure that brings together human beings in order to satisfy economic needs and the wants of a community. It establishes the “organization” as a distinct entity, and management of an organization as a legitimate subject of inquiry. The book represents a link between Drucker’s first two books on society and his subsequent writings on management. Detailed information is provided regarding such management practices as decentralization, pricing, and the roles of profits and of labor unions. Drucker looks at General Motors’ managerial organization and attempts to understand what makes the company work so effectively. Certain questions are addressed, such as: “What are the company’s core principles, and how do they contribute to the success of the organization?” The principles of organization and management at General Motors described in this book became models for organizations worldwide. The book addresses issues that go beyond the borders of the business corporation, and considers the “corporate state” itself.

Buy “Concept of the Corporation” by Peter Drucker

“The New Society – The Anatomy of Industrial Order” (1950)

In The New Society, Peter Drucker extends his previous works The Future of Industrial Man and Concept of the Corporation into a systematic, organized analysis of the industrial society that emerged out of World War II. He analyzes large business enterprises, governments, labor unions, and the place of the individual within the social context of these institutions. Following publication of the of The New Society, George G. Higgins wrote in Commonweal, “Drucker has analyzed, as brilliantly as any modern writer, the problems of industrial relations in the individual company or ‘enterprise.’ He is thoroughly at home in economics, political science, industrial psychology, and industrial sociology, and has succeeded admirably in harmonizing the findings of all four disciplines and applying them meaningfully to the practical problems of the ‘enterprise.’ Drucker believes that the interests of the worker, management, and corporation are reconcilable with society. He advances the idea of “the plant community” in which workers are encouraged to take on more responsibility and act like “managers.” He questions whether unions can survive in their present form if the worker is encouraged to act as a manager.

In The New Society, Peter Drucker extends his previous works The Future of Industrial Man and Concept of the Corporation into a systematic, organized analysis of the industrial society that emerged out of World War II. He analyzes large business enterprises, governments, labor unions, and the place of the individual within the social context of these institutions. Following publication of the of The New Society, George G. Higgins wrote in Commonweal, “Drucker has analyzed, as brilliantly as any modern writer, the problems of industrial relations in the individual company or ‘enterprise.’ He is thoroughly at home in economics, political science, industrial psychology, and industrial sociology, and has succeeded admirably in harmonizing the findings of all four disciplines and applying them meaningfully to the practical problems of the ‘enterprise.’ Drucker believes that the interests of the worker, management, and corporation are reconcilable with society. He advances the idea of “the plant community” in which workers are encouraged to take on more responsibility and act like “managers.” He questions whether unions can survive in their present form if the worker is encouraged to act as a manager.

Buy “The New Society – The Anatomy of Industrial Order” by Peter Drucker

“The Practice of Management” (1954)

This classic is the first book to define management as a practice and a discipline, thus establishing Drucker as the founder of the discipline of modern management. Management has been practiced for centuries, but this book systematically defines management as a discipline that can be taught and learned. It provides a systematic guide for practicing managers who want to improve their effectiveness and productivity. It presents Management by Objectives as a genuine philosophy of management that integrates the interests of the corporation with those of the managers and contributors to an organization. Illustrations come from such companies as Ford, GE, Sears, Roebuck & Co., GM, IBM, and AT&T.

This classic is the first book to define management as a practice and a discipline, thus establishing Drucker as the founder of the discipline of modern management. Management has been practiced for centuries, but this book systematically defines management as a discipline that can be taught and learned. It provides a systematic guide for practicing managers who want to improve their effectiveness and productivity. It presents Management by Objectives as a genuine philosophy of management that integrates the interests of the corporation with those of the managers and contributors to an organization. Illustrations come from such companies as Ford, GE, Sears, Roebuck & Co., GM, IBM, and AT&T.

Buy “The Practice of Management” by Peter Drucker

“America’s Next Twenty Years” (1957)

In this collection of essays, Peter Drucker discusses the issues that he believes will be significant in America, including the coming labor shortage, automation, significant wealth in the hands of a few individuals, college education, American politics, and perhaps most significantly, the growing disparity between the “haves” and the “have nots.” In these essays, Drucker identifies the major events that “have already happened” that will “determine the future.” “Identifying the future that has already happened” is a major theme of Drucker’s many books and essays.

In this collection of essays, Peter Drucker discusses the issues that he believes will be significant in America, including the coming labor shortage, automation, significant wealth in the hands of a few individuals, college education, American politics, and perhaps most significantly, the growing disparity between the “haves” and the “have nots.” In these essays, Drucker identifies the major events that “have already happened” that will “determine the future.” “Identifying the future that has already happened” is a major theme of Drucker’s many books and essays.

Buy “America’s Next Twenty Years” by Peter Drucker

“Landmarks of Tomorrow” (1957)

Landmarks of Tomorrow identifies “the future that has already happened” in three major areas of human life and experience. The first part of the book treats the philosophical shift from a Cartesian universe of mechanical cause to a new universe of pattern, purpose, and configuration. Drucker discusses the need to organize men of knowledge and of high skill for joint effort, and performance as a key component of this change. The second part of the book sketches four realities that challenge the people of the free world: an educated society, economic development, the decline of the effectiveness of government, and the collapse of Eastern culture. The final section of the book is concerned with the spiritual reality of human existence. These are seen as basic elements in late-twentieth-century society. In his new introduction, Peter Drucker revisits the main findings of Landmarks of Tomorrow and assesses their validity in relation to today’s concerns.

Landmarks of Tomorrow identifies “the future that has already happened” in three major areas of human life and experience. The first part of the book treats the philosophical shift from a Cartesian universe of mechanical cause to a new universe of pattern, purpose, and configuration. Drucker discusses the need to organize men of knowledge and of high skill for joint effort, and performance as a key component of this change. The second part of the book sketches four realities that challenge the people of the free world: an educated society, economic development, the decline of the effectiveness of government, and the collapse of Eastern culture. The final section of the book is concerned with the spiritual reality of human existence. These are seen as basic elements in late-twentieth-century society. In his new introduction, Peter Drucker revisits the main findings of Landmarks of Tomorrow and assesses their validity in relation to today’s concerns.

Buy “Landmarks of Tomorrow” by Peter Drucker

“Managing for Results” (1964)

This book focuses upon economic performance as the specific function and contribution of business and the reason for its existence. The effective business, Peter Drucker observes, focuses on opportunities rather than problems. How this focus is achieved in order to make the organization prosper and grow is the subject of this companion to his classic, The Practice of Management. The earlier book was chiefly concerned with how management functions as a discipline and practice, this volume shows what the executive decision-maker must do to move his enterprise forward. One of the notable accomplishments of this book is its combining of specific economic analysis with the entrepreneurial force in business prosperity. For though it discusses “what to do” more than Drucker’s previous works, the book stresses the qualitative aspect of enterprise: every successful business requires a goal and spirit all its own. Managing for Results was the first book to describe what is now widely called “business strategy” and to identify what are now called an organization’s “core competencies.”

This book focuses upon economic performance as the specific function and contribution of business and the reason for its existence. The effective business, Peter Drucker observes, focuses on opportunities rather than problems. How this focus is achieved in order to make the organization prosper and grow is the subject of this companion to his classic, The Practice of Management. The earlier book was chiefly concerned with how management functions as a discipline and practice, this volume shows what the executive decision-maker must do to move his enterprise forward. One of the notable accomplishments of this book is its combining of specific economic analysis with the entrepreneurial force in business prosperity. For though it discusses “what to do” more than Drucker’s previous works, the book stresses the qualitative aspect of enterprise: every successful business requires a goal and spirit all its own. Managing for Results was the first book to describe what is now widely called “business strategy” and to identify what are now called an organization’s “core competencies.”

Buy “Managing for Results” by Peter Drucker

“The Effective Executive” (1966)

The Effective Executive is a landmark book that develops the specific practices of the executive that lead to effectiveness. It is based on observations of effective executives in business and government. Drucker starts by reminding executives that the measure of effectiveness is the ability to “get the right things done.” This involves five practices: (1) managing one’s time, (2) focusing on contribution rather than problems, (3) making strengths productive, (4) establishing priorities, and (5) making effective decisions. A major portion of the book is devoted to the process of making effective decisions and the criteria for effective decisions. Numerous examples are provided of executive effectiveness. The book concludes by emphasizing that effectiveness can be learned and must be learned.

The Effective Executive is a landmark book that develops the specific practices of the executive that lead to effectiveness. It is based on observations of effective executives in business and government. Drucker starts by reminding executives that the measure of effectiveness is the ability to “get the right things done.” This involves five practices: (1) managing one’s time, (2) focusing on contribution rather than problems, (3) making strengths productive, (4) establishing priorities, and (5) making effective decisions. A major portion of the book is devoted to the process of making effective decisions and the criteria for effective decisions. Numerous examples are provided of executive effectiveness. The book concludes by emphasizing that effectiveness can be learned and must be learned.

Buy “The Effective Executive” by Peter Drucker

“The Age of Discontinuity” (1968)

Peter Drucker focuses with great clarity and perception on the forces of change that are transforming the economic landscape and creating tomorrow’s society. He discerns four major areas of discontinuity underlying contemporary social and cultural reality: (I) the explosion of new technologies resulting in major new industries, (2) the change from an international to a world economy, (3) a new sociopolitical reality of pluralistic institutions that poses drastic political, philosophical, and spiritual challenges, and (4) the new universe of knowledge work based on mass education along with its implications. The Age of Discontinuity is a fascinating and important blueprint for shaping a future already very much with us.

Peter Drucker focuses with great clarity and perception on the forces of change that are transforming the economic landscape and creating tomorrow’s society. He discerns four major areas of discontinuity underlying contemporary social and cultural reality: (I) the explosion of new technologies resulting in major new industries, (2) the change from an international to a world economy, (3) a new sociopolitical reality of pluralistic institutions that poses drastic political, philosophical, and spiritual challenges, and (4) the new universe of knowledge work based on mass education along with its implications. The Age of Discontinuity is a fascinating and important blueprint for shaping a future already very much with us.

Buy “The Age of Discontinuity” by Peter Drucker

“Men, Ideas, and Politics” (1970)

Technology, Management, and Society presents an overview of the nature of modern technology and its relationships with science, engineering, and religion. The social and political forces, which increasingly impinge on technological development, are analyzed within the framework of broad institutional change. Scholars and students troubled by society’s growing reliance on technological solutions to complex social and political problems will welcome Peter Drucker’s critical perspective.

Technology, Management, and Society presents an overview of the nature of modern technology and its relationships with science, engineering, and religion. The social and political forces, which increasingly impinge on technological development, are analyzed within the framework of broad institutional change. Scholars and students troubled by society’s growing reliance on technological solutions to complex social and political problems will welcome Peter Drucker’s critical perspective.

Buy “Men, Ideas, and Politics” by Peter Drucker

“Technology, Management, and Society” (1971)

This book is a compilation of thirteen essays addressing the issues of society “people, politics, and thought. Included are essays on Henry Ford, Japanese management, and effective presidents. Two articles in particular show aspects of Drucker’s thinking that are especially important. One is an essay on “The Unfashionable Kierkegaard,” which encourages the development of the spiritual dimension of humankind. The other is on the political philosophy of John C. Calhoun, describing the basic principles of lsowo0 America’s pluralism and how they shape government policies and programs.

This book is a compilation of thirteen essays addressing the issues of society “people, politics, and thought. Included are essays on Henry Ford, Japanese management, and effective presidents. Two articles in particular show aspects of Drucker’s thinking that are especially important. One is an essay on “The Unfashionable Kierkegaard,” which encourages the development of the spiritual dimension of humankind. The other is on the political philosophy of John C. Calhoun, describing the basic principles of lsowo0 America’s pluralism and how they shape government policies and programs.

Buy “Technology, Management, and Society” by Peter Drucker

“Management: Tasks, Responsibilities, Practices” (1973)

This book is a compendium of Drucker on management. It updates and expands upon The Practice of Management. It is an essential reference book for executives. Management is an organized body of knowledge consisting of managerial tasks, managerial work, managerial tools, managerial responsibilities, and the role of top management. According to Peter Drucker, “This book tries to equip the manager with the understanding, the thinking, the knowledge, and the skills for today’s and also tomorrow’s jobs.” This management classic has been developed and tested during more than thirty years of management teaching in universities, executive programs, seminars, and through the author’s close work with managers as a consultant for large and small businesses, government agencies, hospitals, and schools.

This book is a compendium of Drucker on management. It updates and expands upon The Practice of Management. It is an essential reference book for executives. Management is an organized body of knowledge consisting of managerial tasks, managerial work, managerial tools, managerial responsibilities, and the role of top management. According to Peter Drucker, “This book tries to equip the manager with the understanding, the thinking, the knowledge, and the skills for today’s and also tomorrow’s jobs.” This management classic has been developed and tested during more than thirty years of management teaching in universities, executive programs, seminars, and through the author’s close work with managers as a consultant for large and small businesses, government agencies, hospitals, and schools.

Buy “Management: Tasks, Responsibilities, Practices” by Peter Drucker

“The Pension Fund Revolution” (1976)

In this book, Drucker describes how institutional investors, especially pension funds, have become the controlling owners of America’s large companies, and the country’s “capitalists.” He explores how ownership has become highly concentrated in the hands of large institutional investors, and that through the pension funds, “ownership of the means of production” has become “socialized” without becoming “nationalized.” Another theme of this book is the aging of America. Drucker points to the new challenges this trend will pose with respect to health care, pensions, and social security’s place in the American economy and society, and how, altogether, American politics would increasingly become dominated by middle-class issues and with the values of elderly people. In the new epilogue, Drucker discusses how the increasing dominance of pension funds represents one of the most startling power shifts in economic history, and examines their present-day impact.

In this book, Drucker describes how institutional investors, especially pension funds, have become the controlling owners of America’s large companies, and the country’s “capitalists.” He explores how ownership has become highly concentrated in the hands of large institutional investors, and that through the pension funds, “ownership of the means of production” has become “socialized” without becoming “nationalized.” Another theme of this book is the aging of America. Drucker points to the new challenges this trend will pose with respect to health care, pensions, and social security’s place in the American economy and society, and how, altogether, American politics would increasingly become dominated by middle-class issues and with the values of elderly people. In the new epilogue, Drucker discusses how the increasing dominance of pension funds represents one of the most startling power shifts in economic history, and examines their present-day impact.

Buy “The Pension Fund Revolution” by Peter Drucker

“Adventures of a Bystander” (1978)

Adventures of a Bystander is Drucker’s collection of autobiographical stories and vignettes, in which he paints a portrait of his life, and of the larger historical realities of his time. Drucker conveys his life story “from his early teen years in Vienna through the interwar years in Europe, the New Deal era, World War II, and the postwar period in America” … “through intimate profiles of a host of fascinating people he’s known through the years. Along with bankers and courtesans, artists, aristocrats, prophets, and empire builders, we meet members of Drucker’s own family and close circle of friends, among them such prominent figures as Sigmund Freud, Henry Luce, Alfred Sloan, John Lewis, and Buckminster Fuller. Shedding light on a turbulent and important era, Adventures of a Bystander also reflects Peter Drucker himself as a man of imaginative sympathy and enormous interest in people, ideas, and history.

Adventures of a Bystander is Drucker’s collection of autobiographical stories and vignettes, in which he paints a portrait of his life, and of the larger historical realities of his time. Drucker conveys his life story “from his early teen years in Vienna through the interwar years in Europe, the New Deal era, World War II, and the postwar period in America” … “through intimate profiles of a host of fascinating people he’s known through the years. Along with bankers and courtesans, artists, aristocrats, prophets, and empire builders, we meet members of Drucker’s own family and close circle of friends, among them such prominent figures as Sigmund Freud, Henry Luce, Alfred Sloan, John Lewis, and Buckminster Fuller. Shedding light on a turbulent and important era, Adventures of a Bystander also reflects Peter Drucker himself as a man of imaginative sympathy and enormous interest in people, ideas, and history.

Buy “Adventures of a Bystander” by Peter Drucker

“Managing in Turbulent Times” (1980)

This important and timely book concerns the immediate future of business, society, and the economy. We are, says Drucker, entering a new economic era with new trends, new markets, a global economy, new technologies, and new institutions. How will managers and management deal with the turbulence created by these new realities? This book, as Drucker explains it, “is concerned with action, rather than understanding, with decisions, rather than analysis.” It deals with the strategies needed to adapt to change and to turn rapid changes into opportunities, to turn the threat of change into productive and profitable action that contributes positively to our society, the economy, and the individual. An organization must be structured to withstand a blow caused by environmental turbulence.

This important and timely book concerns the immediate future of business, society, and the economy. We are, says Drucker, entering a new economic era with new trends, new markets, a global economy, new technologies, and new institutions. How will managers and management deal with the turbulence created by these new realities? This book, as Drucker explains it, “is concerned with action, rather than understanding, with decisions, rather than analysis.” It deals with the strategies needed to adapt to change and to turn rapid changes into opportunities, to turn the threat of change into productive and profitable action that contributes positively to our society, the economy, and the individual. An organization must be structured to withstand a blow caused by environmental turbulence.

Buy “Managing in Turbulent Times” by Peter Drucker

“Toward the Next Economics” (1981)

These essays cover a wide-ranging collection of topics on business, management, economics, and society. They are all concerned with what Drucker calls “social ecology” and especially with institutions. These essays reflect ‘the future that has already happened.”, The essays reflect Drucker’s belief that, in the decade of the 1970s, there were genuine changes in population structure and dynamics, changes in the role of institutions, changes in the relation between sciences and society, and changes in the fundamental theories about economics and society, long considered as truths. The essays are international in scope.

These essays cover a wide-ranging collection of topics on business, management, economics, and society. They are all concerned with what Drucker calls “social ecology” and especially with institutions. These essays reflect ‘the future that has already happened.”, The essays reflect Drucker’s belief that, in the decade of the 1970s, there were genuine changes in population structure and dynamics, changes in the role of institutions, changes in the relation between sciences and society, and changes in the fundamental theories about economics and society, long considered as truths. The essays are international in scope.

Buy “Toward the Next Economics” by Peter Drucker

“The Changing World of the Executive” (1982)

These essays from the Wall Street Journal explore a wide variety of topics. They deal with changes in the workforce “its jobs, its expectations” with the power relationships of a “society of employees,” and with changes in technology and in the world economy. They discuss the problems and challenges facing major institutions, including business enterprises, schools, hospitals, and government agencies. They look anew at the tasks and work of executives, at their performance and its measurement, and at executive compensation. However diverse the topics, these chapters have one common theme, the changing world of the executive “changing rapidly within the organization, changing rapidly with respect to the visions, aspirations, and even characteristics of employees, customers, and constituents, changing outside the organization, as well, economically, technologically, socially, politically.

These essays from the Wall Street Journal explore a wide variety of topics. They deal with changes in the workforce “its jobs, its expectations” with the power relationships of a “society of employees,” and with changes in technology and in the world economy. They discuss the problems and challenges facing major institutions, including business enterprises, schools, hospitals, and government agencies. They look anew at the tasks and work of executives, at their performance and its measurement, and at executive compensation. However diverse the topics, these chapters have one common theme, the changing world of the executive “changing rapidly within the organization, changing rapidly with respect to the visions, aspirations, and even characteristics of employees, customers, and constituents, changing outside the organization, as well, economically, technologically, socially, politically.

Buy “The Changing World of the Executive” by Peter Drucker

“Innovation and Entrepreneurship” (1985)

The first book to present innovation and entrepreneurship as a purposeful and systematic discipline. It explains and analyzes the challenges and opportunities presented by the emergence of the entrepreneurial economy in business and public service institutions. It is a major contribution to functioning management, organization, and economy. The book is divided into three main sections: (1) The Practice of Innovation, (2) The Practice of Entrepreneurship, and (3) Entrepreneurial Strategies. Drucker presents innovation and entrepreneurship as both practice and discipline, choosing to focus on the actions of the entrepreneur as opposed to entrepreneurial psychology and temperament. All organizations, including public-service institutions, must become entrepreneurial to survive and prosper in a market economy. The book provides a description of entrepreneurial policies and windows of opportunity for developing innovative practices in both emerging and well-established organizations.

The first book to present innovation and entrepreneurship as a purposeful and systematic discipline. It explains and analyzes the challenges and opportunities presented by the emergence of the entrepreneurial economy in business and public service institutions. It is a major contribution to functioning management, organization, and economy. The book is divided into three main sections: (1) The Practice of Innovation, (2) The Practice of Entrepreneurship, and (3) Entrepreneurial Strategies. Drucker presents innovation and entrepreneurship as both practice and discipline, choosing to focus on the actions of the entrepreneur as opposed to entrepreneurial psychology and temperament. All organizations, including public-service institutions, must become entrepreneurial to survive and prosper in a market economy. The book provides a description of entrepreneurial policies and windows of opportunity for developing innovative practices in both emerging and well-established organizations.

Buy “Innovation and Entrepreneurship” by Peter Drucker

“The Frontiers of Management” (1986)

This book is a collection of thirty-five previously published articles and essays, twenty-five of which have appeared on the editorial page of the Wall Street Journal. Featuring a new introduction, Drucker forecasts the business trends of what was then the next millennium. The Frontiers of Management is a clear, direct, lively, and comprehensible examination of global trends and management practices. There are chapters dealing with the world economy, hostile takeovers, and the unexpected problems of success. Jobs, younger people, and career gridlock are also covered. Throughout this book, Drucker stresses the importance of forethought and of realizing that “change is opportunity” in every branch of executive decision-making.

This book is a collection of thirty-five previously published articles and essays, twenty-five of which have appeared on the editorial page of the Wall Street Journal. Featuring a new introduction, Drucker forecasts the business trends of what was then the next millennium. The Frontiers of Management is a clear, direct, lively, and comprehensible examination of global trends and management practices. There are chapters dealing with the world economy, hostile takeovers, and the unexpected problems of success. Jobs, younger people, and career gridlock are also covered. Throughout this book, Drucker stresses the importance of forethought and of realizing that “change is opportunity” in every branch of executive decision-making.

Buy “The Frontiers of Management” by Peter Drucker

“The New Realities” (1989)

This book is about the “next century.” Its thesis is that the “next century” is already here, indeed that we are well advanced into it. In this book, Drucker writes about the “social superstructure” politics and government, society, economy and economics, social organization, and the new knowledge society. He describes the limits of government and dangers of “charisma” in leadership. He identifies the future organization as being information-based. While this book is not “futurism,” it attempts to define the concerns, the issues, and the controversies that will be realities for years to come. Drucker focuses on what to do today in contemplation of tomorrow. Within self-imposed limitations, he attempts to set the agenda on how to deal with some of the toughest problems we are facing today that have been created by the successes of the past.

This book is about the “next century.” Its thesis is that the “next century” is already here, indeed that we are well advanced into it. In this book, Drucker writes about the “social superstructure” politics and government, society, economy and economics, social organization, and the new knowledge society. He describes the limits of government and dangers of “charisma” in leadership. He identifies the future organization as being information-based. While this book is not “futurism,” it attempts to define the concerns, the issues, and the controversies that will be realities for years to come. Drucker focuses on what to do today in contemplation of tomorrow. Within self-imposed limitations, he attempts to set the agenda on how to deal with some of the toughest problems we are facing today that have been created by the successes of the past.

Buy “The New Realities” by Peter Drucker

“Managing the Non-Profit Organization” (1990)

The service, or nonprofit, sector of our society is growing rapidly (with more than 8 million employees and more than 80 million volunteers), creating a major need for guidelines and expert advice on how to lead and manage these organizations effectively. This book is an application of Drucker’s perspective on management to nonprofit organizations of all kinds. He gives examples and explanations of mission, leadership, resources, marketing, goals, people development, decision-making, and much more. Included are interviews with nine experts that address key issues in the nonprofit sector.

The service, or nonprofit, sector of our society is growing rapidly (with more than 8 million employees and more than 80 million volunteers), creating a major need for guidelines and expert advice on how to lead and manage these organizations effectively. This book is an application of Drucker’s perspective on management to nonprofit organizations of all kinds. He gives examples and explanations of mission, leadership, resources, marketing, goals, people development, decision-making, and much more. Included are interviews with nine experts that address key issues in the nonprofit sector.

Buy “Managing the Non-Profit Organization” by Peter Drucker

“Managing for the Future” (1992)

Bringing together the most exciting of Drucker’s many recent essays on economics, business practices, managing for change, and the evolving shape of the modern corporation, Managing for the Future offers important insights and lessons for anyone trying to stay ahead of today’s unremitting competition. Drucker’s universe is a constantly expanding cosmos composed of four regions in which he demonstrates mastery: (1) the economic forces affecting our lives and livelihoods, (2) today’s changing workforce and workplaces, (3) the newest management concepts and practices, and (4) the shape of the organization, including the corporation, as it evolves and responds to ever-increasing tasks and responsibilities. Each of this book’s chapters explores a business or corporate or “people” problem, and Drucker shows how to solve it or use it as an opportunity for change.

Bringing together the most exciting of Drucker’s many recent essays on economics, business practices, managing for change, and the evolving shape of the modern corporation, Managing for the Future offers important insights and lessons for anyone trying to stay ahead of today’s unremitting competition. Drucker’s universe is a constantly expanding cosmos composed of four regions in which he demonstrates mastery: (1) the economic forces affecting our lives and livelihoods, (2) today’s changing workforce and workplaces, (3) the newest management concepts and practices, and (4) the shape of the organization, including the corporation, as it evolves and responds to ever-increasing tasks and responsibilities. Each of this book’s chapters explores a business or corporate or “people” problem, and Drucker shows how to solve it or use it as an opportunity for change.

Buy “Managing for the Future” by Peter Drucker

“The Ecological Vision” (1993)

The thirty-one essays in this volume were written over a period of more than forty years. These essays range over a wide array of disciplines and subject matter. Yet they all have in common that they are “Essays in Social Ecology” and deal with the man-made environment. They all, in one way or another, deal with the interaction between individual and community. In addition, they try to look upon the economy, upon technology, upon art, as dimensions of social experience and as expressions of social values. The last essay in this collection, The Unfashionable Kierkegaard, was written as an affirmation of the existential, the spiritual, and the individual dimension of the Creature. It was written by Drucker to assert that society is not enough “not even for society. It was written to affirm hope. This is an important and perceptive volume of essays.

The thirty-one essays in this volume were written over a period of more than forty years. These essays range over a wide array of disciplines and subject matter. Yet they all have in common that they are “Essays in Social Ecology” and deal with the man-made environment. They all, in one way or another, deal with the interaction between individual and community. In addition, they try to look upon the economy, upon technology, upon art, as dimensions of social experience and as expressions of social values. The last essay in this collection, The Unfashionable Kierkegaard, was written as an affirmation of the existential, the spiritual, and the individual dimension of the Creature. It was written by Drucker to assert that society is not enough “not even for society. It was written to affirm hope. This is an important and perceptive volume of essays.

Buy “The Ecological Vision” by Peter Drucker

“Post-Capitalist Society” (1993)

In Post-Capitalist Society, Peter Drucker describes how every few hundred years a sharp transformation has taken place and greatly affected society “its worldview, its basic values, its business and economics, and its social and political structure. According to Drucker, we are right in the middle of another time of radical change, from the Age of Capitalism and the Nation-State to a Knowledge Society and a Society of Organizations. The primary resource in the post-capitalist society will be knowledge, and the leading social groups will be “knowledge workers.” Looking backward and forward, Drucker discusses the Industrial Revolution, the Productivity Revolution, the Management Revolution, and the governance of corporations. He explains the new functions of organizations, the economics of knowledge, and productivity as a social and economic priority. He covers the transformation from Nation-State to Megastate, the new pluralism of political systems, and the needed turnaround in government. Finally, Drucker details the knowledge issues and the role and use of knowledge in the post-capitalist society. Divided into three parts “Society, Polity, and Knowledge” Post-Capitalist Society provides a searching look into the future as well as a vital analysis of the past, focusing on the challenges of the present transition period and how, if we can understand and respond to them, we can create a new future.

In Post-Capitalist Society, Peter Drucker describes how every few hundred years a sharp transformation has taken place and greatly affected society “its worldview, its basic values, its business and economics, and its social and political structure. According to Drucker, we are right in the middle of another time of radical change, from the Age of Capitalism and the Nation-State to a Knowledge Society and a Society of Organizations. The primary resource in the post-capitalist society will be knowledge, and the leading social groups will be “knowledge workers.” Looking backward and forward, Drucker discusses the Industrial Revolution, the Productivity Revolution, the Management Revolution, and the governance of corporations. He explains the new functions of organizations, the economics of knowledge, and productivity as a social and economic priority. He covers the transformation from Nation-State to Megastate, the new pluralism of political systems, and the needed turnaround in government. Finally, Drucker details the knowledge issues and the role and use of knowledge in the post-capitalist society. Divided into three parts “Society, Polity, and Knowledge” Post-Capitalist Society provides a searching look into the future as well as a vital analysis of the past, focusing on the challenges of the present transition period and how, if we can understand and respond to them, we can create a new future.

Buy “Post-Capitalist Society” by Peter Drucker

“Managing in a Time of Great Change” (1995)

This book compiles essays written by Drucker from 1991 to 1994 and published in the Harvard Business Review and the Wall Street Journal. All of these essays are about change: changes in the economy, society, business, and in organizations in general. Drucker’s advice on how managers should adjust to these tectonic shifts centers on the rise of the now-ubiquitous knowledge worker and the global economy. In this book, Drucker illuminates the business challenges confronting us today. He examines current management trends and whether they really work, the implications for business in the reinvention of the government, and the shifting balance of power between management and labor.

This book compiles essays written by Drucker from 1991 to 1994 and published in the Harvard Business Review and the Wall Street Journal. All of these essays are about change: changes in the economy, society, business, and in organizations in general. Drucker’s advice on how managers should adjust to these tectonic shifts centers on the rise of the now-ubiquitous knowledge worker and the global economy. In this book, Drucker illuminates the business challenges confronting us today. He examines current management trends and whether they really work, the implications for business in the reinvention of the government, and the shifting balance of power between management and labor.

Buy “Managing in a Time of Great Change” by Peter Drucker

“Drucker on Asia” (1995) with Isao Nakauchi

Drucker on Asia is the result of an extensive dialogue between two of the world’s leading business figures, Peter F. Drucker and Isao Nakauchi. Their dialogue considers the changes occurring in the economic world today and identifies the challenges that free markets and free enterprises now face, with specific reference to China and Japan. What do these changes mean to Japan? What does Japan have to do in order to achieve a “third economic miracle”? What do these changes mean to society, the individual company, the individual professional and executive? These are the questions that Drucker and Nakauchi address in their brilliant insight into the future economic role of Asia.

Drucker on Asia is the result of an extensive dialogue between two of the world’s leading business figures, Peter F. Drucker and Isao Nakauchi. Their dialogue considers the changes occurring in the economic world today and identifies the challenges that free markets and free enterprises now face, with specific reference to China and Japan. What do these changes mean to Japan? What does Japan have to do in order to achieve a “third economic miracle”? What do these changes mean to society, the individual company, the individual professional and executive? These are the questions that Drucker and Nakauchi address in their brilliant insight into the future economic role of Asia.

Buy “Drucker on Asia” by Peter Drucker

“Peter Drucker on the Profession of Management” (1996)

This is a significant collection of Peter Drucker’s landmark articles from the Harvard Business Review. Drucker seeks out, identifies, and examines the most important issues confronting managers, from corporate strategy to management style to social change. This volume provides a rare opportunity to trace the evolution of great shifts in our workplaces, and to understand more clearly the role of managers in the ongoing effort to balance change with continuity, the latter a recurring theme in Drucker’s writings. These are strategically presented here to address two unifying themes: the first examines the “Manager’s Responsibilities,” while the second investigates “The Executive’s World.” Containing an important interview with Drucker on “The Post-Capitalist Executive,” as well as a preface by Drucker himself, the volume is edited by Nan Stone, longtime editor of the Harvard Business Review.

This is a significant collection of Peter Drucker’s landmark articles from the Harvard Business Review. Drucker seeks out, identifies, and examines the most important issues confronting managers, from corporate strategy to management style to social change. This volume provides a rare opportunity to trace the evolution of great shifts in our workplaces, and to understand more clearly the role of managers in the ongoing effort to balance change with continuity, the latter a recurring theme in Drucker’s writings. These are strategically presented here to address two unifying themes: the first examines the “Manager’s Responsibilities,” while the second investigates “The Executive’s World.” Containing an important interview with Drucker on “The Post-Capitalist Executive,” as well as a preface by Drucker himself, the volume is edited by Nan Stone, longtime editor of the Harvard Business Review.

Buy “Peter Drucker on the Profession of Management” by Peter Drucker

“Management Challenges for the 21st Century” (1998)

In this compilation of essays culled from published magazine articles and a lengthy essay appearing in The Economist in November 2001, and interviews during the period of 1996 to 2002, Drucker has expertly anticipated our ever-changing business society and ever-expanding management roles. In this book, Drucker identifies the reality of the ‘Next Society,” which has been shaped by three major trends: the decline of the young portion of the population, the decline of manufacturing, and the transformation of the workforce (together with the social impact of the Information Revolution). Drucker also asserts that e-commerce and e-learning are to the Information Revolution what the railroad was to the Industrial Revolution, and thus, an information society is developing. Drucker speaks of the importance of the social sector (that is, nongovernmental and nonprofit organizations), because NPOs can create what we now need: communities for citizens and especially for highly educated knowledge-workers, who increasingly dominate developed societies.

In this compilation of essays culled from published magazine articles and a lengthy essay appearing in The Economist in November 2001, and interviews during the period of 1996 to 2002, Drucker has expertly anticipated our ever-changing business society and ever-expanding management roles. In this book, Drucker identifies the reality of the ‘Next Society,” which has been shaped by three major trends: the decline of the young portion of the population, the decline of manufacturing, and the transformation of the workforce (together with the social impact of the Information Revolution). Drucker also asserts that e-commerce and e-learning are to the Information Revolution what the railroad was to the Industrial Revolution, and thus, an information society is developing. Drucker speaks of the importance of the social sector (that is, nongovernmental and nonprofit organizations), because NPOs can create what we now need: communities for citizens and especially for highly educated knowledge-workers, who increasingly dominate developed societies.

Buy “Management Challenges for the 21st Century” by Peter Drucker

“Managing in the Next Society” (1999)

In his first major book since The Post-Capitalist Society, Drucker discusses the new paradigms of management “how they have changed and will continue to change our basic assumptions about the practices and principles of management. Drucker analyzes the new realities of strategy, shows how to be a leader in periods of change, and explains the “New Information Revolution,” discussing the information an executive needs and the information an executive owes. He also examines knowledge-worker productivity, and shows that changes in the basic attitude of individuals and organizations, as well as structural changes in work itself, are needed for increased productivity. Finally, Drucker addresses the ultimate challenge of managing oneself while meeting the demands on the individual during a longer working life and in an ever-changing workplace.

In his first major book since The Post-Capitalist Society, Drucker discusses the new paradigms of management “how they have changed and will continue to change our basic assumptions about the practices and principles of management. Drucker analyzes the new realities of strategy, shows how to be a leader in periods of change, and explains the “New Information Revolution,” discussing the information an executive needs and the information an executive owes. He also examines knowledge-worker productivity, and shows that changes in the basic attitude of individuals and organizations, as well as structural changes in work itself, are needed for increased productivity. Finally, Drucker addresses the ultimate challenge of managing oneself while meeting the demands on the individual during a longer working life and in an ever-changing workplace.

Buy “Managing in the Next Society” by Peter Drucker

“The Daily Drucker” (2002)

Revered management thinker Peter F. Drucker is our trusted guide in this thoughtful, day-by-day companion that offers his penetrating and practical wisdom. Amid the multiple pressures of our daily work lives, The Daily Drucker provides the inspiration and advice to meet the many challenges we face. With his trademark clarity, vision, and humanity, Drucker sets out his ideas on a broad swath of key topics, from time management, to innovation, to outsourcing, providing useful insights for each day of the year. These 366 daily readings have been harvested from Drucker’s lifetime of work. At the bottom of each page, the reader will find an action point that spells out exactly how to put Drucker’s ideas into practice. It is as if the wisest and most action-oriented management consultant in the world is in the room, offering his timeless gems of advice. The Daily Drucker is for anyone who seeks to understand and put to use Drucker’s powerful words and ideas.

Revered management thinker Peter F. Drucker is our trusted guide in this thoughtful, day-by-day companion that offers his penetrating and practical wisdom. Amid the multiple pressures of our daily work lives, The Daily Drucker provides the inspiration and advice to meet the many challenges we face. With his trademark clarity, vision, and humanity, Drucker sets out his ideas on a broad swath of key topics, from time management, to innovation, to outsourcing, providing useful insights for each day of the year. These 366 daily readings have been harvested from Drucker’s lifetime of work. At the bottom of each page, the reader will find an action point that spells out exactly how to put Drucker’s ideas into practice. It is as if the wisest and most action-oriented management consultant in the world is in the room, offering his timeless gems of advice. The Daily Drucker is for anyone who seeks to understand and put to use Drucker’s powerful words and ideas.

Buy “The Daily Drucker” by Peter Drucker

“The Effective Executive in Action” (2004)

The Effective Executive in Action is a journal based on Peter F. Drucker’s classic and preeminent work on management and effectiveness “The Effective Executive“. Here Drucker and Maciariello provide executives, managers, and knowledge workers with a guide to effective action “the central theme of Drucker’s work. The authors take more than one hundred readings from Drucker’s classic work, update them, and provide provocative questions to ponder and actions to take in order to improve your own work. Also included in this journal is a space for you to record your thoughts for later review and reflection. “The Effective Executive in Action” will teach you how to be a better leader and how to lead according to the five main pillars of Drucker’s leadership philosophy.

The Effective Executive in Action is a journal based on Peter F. Drucker’s classic and preeminent work on management and effectiveness “The Effective Executive“. Here Drucker and Maciariello provide executives, managers, and knowledge workers with a guide to effective action “the central theme of Drucker’s work. The authors take more than one hundred readings from Drucker’s classic work, update them, and provide provocative questions to ponder and actions to take in order to improve your own work. Also included in this journal is a space for you to record your thoughts for later review and reflection. “The Effective Executive in Action” will teach you how to be a better leader and how to lead according to the five main pillars of Drucker’s leadership philosophy.

Buy “The Effective Executive in Action” by Peter Drucker

“Managing Oneself” (2007)

We live in an age of unprecedented opportunity: with ambition, drive, and talent, you can rise to the top of your chosen profession regardless of where you started out. However, with opportunity comes responsibility. Companies today are not managing their knowledge workers’ careers. Instead, you must be your own chief executive officer. That means it is up to you to carve out your place in the world and know when to change course. In addition, it is up to you to keep yourself engaged and productive during a career that may span some 50 years. In Managing Oneself, Peter Drucker explains how to do it. The keys: Cultivate a deep understanding of yourself by identifying your most valuable strengths and most dangerous weaknesses. Articulate how you learn and work with others and what your most deeply held values are. Describe the type of work environment where you can make the greatest contribution. Only when you operate with a combination of your strengths and self-knowledge can you achieve true and lasting excellence. Managing Oneself identifies the probing questions you need to ask to gain the insights essential for taking charge of your career.

We live in an age of unprecedented opportunity: with ambition, drive, and talent, you can rise to the top of your chosen profession regardless of where you started out. However, with opportunity comes responsibility. Companies today are not managing their knowledge workers’ careers. Instead, you must be your own chief executive officer. That means it is up to you to carve out your place in the world and know when to change course. In addition, it is up to you to keep yourself engaged and productive during a career that may span some 50 years. In Managing Oneself, Peter Drucker explains how to do it. The keys: Cultivate a deep understanding of yourself by identifying your most valuable strengths and most dangerous weaknesses. Articulate how you learn and work with others and what your most deeply held values are. Describe the type of work environment where you can make the greatest contribution. Only when you operate with a combination of your strengths and self-knowledge can you achieve true and lasting excellence. Managing Oneself identifies the probing questions you need to ask to gain the insights essential for taking charge of your career.

Buy “Managing Oneself” by Peter Drucker

Anthologies by Peter Drucker

“The Essential Drucker” (2001)

The Essential Drucker offers, in Drucker’s words, “a coherent and fairly comprehensive ‘Introduction to Management’ and gives an overview of my management work and thus answers the question I’ve been asked again and again: ‘Which writings is Essential?’ The book contains twenty-six selections on management in the organization, management and the individual, and management in society. It covers the basic principles and concerns of management and its problems, challenges, and opportunities, giving managers, executives, and professionals the tools to perform the tasks that the economy and society of today and tomorrow will demand of them.

The Essential Drucker offers, in Drucker’s words, “a coherent and fairly comprehensive ‘Introduction to Management’ and gives an overview of my management work and thus answers the question I’ve been asked again and again: ‘Which writings is Essential?’ The book contains twenty-six selections on management in the organization, management and the individual, and management in society. It covers the basic principles and concerns of management and its problems, challenges, and opportunities, giving managers, executives, and professionals the tools to perform the tasks that the economy and society of today and tomorrow will demand of them.

Buy “The Essential Drucker” by Peter Drucker

“A Functioning Society” (2003)

In these essays, Drucker has brought together selections from his vast writings on community, society, and the political structure. Drucker’s primary concern is with a functioning society in which the individual has status and function. Parts I and II identify the institutions that could recreate community, the collapse of which produced totalitarianism in Europe. These selections were written during World War II. Part III deals with the limits of governmental competence in the social and economic realm. This section is concerned with the differences between big government and effective government.

In these essays, Drucker has brought together selections from his vast writings on community, society, and the political structure. Drucker’s primary concern is with a functioning society in which the individual has status and function. Parts I and II identify the institutions that could recreate community, the collapse of which produced totalitarianism in Europe. These selections were written during World War II. Part III deals with the limits of governmental competence in the social and economic realm. This section is concerned with the differences between big government and effective government.

Buy “A Functioning Society” by Peter Drucker

Novels by Peter Drucker

“The Last of All Possible Worlds” (1982)

This novel occurs in the world of upper-class European society of the transitional age just before World War I. At the center of this novel are the lives of four distinguished Europeans who reach their later years around the turn-of-the-century.

This novel occurs in the world of upper-class European society of the transitional age just before World War I. At the center of this novel are the lives of four distinguished Europeans who reach their later years around the turn-of-the-century.

- The aristocratic Polish Prince Sobieski, a wealthy landowner, businessperson, and the Austro-Hungarian diplomat to Great Britain

- McGregor Hinton, a mathematics historian and an immensely successful banker, who faces an ethical crisis and reviews his life, his poor beginnings, his noble secret marriage to a prostitute after she bore his deformed child, and his brushes with aristocracy.

- A wealthy Jewish banker Julius von Mosenthal is planning a major restructuring of a bank while ruminating on the future meeting with partners Hinton and Sobieski

- Baroness Rafaela Wald-Reifnitz—descended from the purest Sephardic Jews, painted by two great artists, devoted to music, in love with her problematic husband Arthur.

Buy “The Last of All Possible Worlds” by Peter Drucker

“The Temptation to Do Good” (1984)

“The Temptation to Do Good”, like “The Last of all Possible Worlds”, is outstanding and brilliant. They are very important additions to Peter Drucker’s outstanding and comprehensive picture of management thinking and practice. The Temptation to Do Good features Father Heinz Zimmerman, the President of a Catholic university. Father Zimmerman faces all of the leadership challenges common to nonprofit CEOs: budgets, donors, staff conflicts, board members, and ethical issues. If you’d add to the mix student and faculty and their expectations, you’ll come to appreciate the sense and purpose of an organization more.

“The Temptation to Do Good”, like “The Last of all Possible Worlds”, is outstanding and brilliant. They are very important additions to Peter Drucker’s outstanding and comprehensive picture of management thinking and practice. The Temptation to Do Good features Father Heinz Zimmerman, the President of a Catholic university. Father Zimmerman faces all of the leadership challenges common to nonprofit CEOs: budgets, donors, staff conflicts, board members, and ethical issues. If you’d add to the mix student and faculty and their expectations, you’ll come to appreciate the sense and purpose of an organization more.

Buy “The Temptation to Do Good” by Peter Drucker

6:00 PM to 9:00 PM: Cocktail Reception at Borsheim’s Fine Jewelry. Borsheim’s is Berkshire’s flagship jewelry retailer and the second biggest jewelry store in the world. This cocktail reception is exceptionally crowded. And Borsheim’s also sets a tent in the parking lot to accommodate the swarms of people enjoying the dinner buffet, open bar, and live musical entertainment, all complimentary. Vegetarians can get their fill of broccoli, cauliflower, carrots, and crackers. Location: Borsheim’s, 120 Regency Parkway, Omaha NE 68114 [map], (800) 642-4438.

6:00 PM to 9:00 PM: Cocktail Reception at Borsheim’s Fine Jewelry. Borsheim’s is Berkshire’s flagship jewelry retailer and the second biggest jewelry store in the world. This cocktail reception is exceptionally crowded. And Borsheim’s also sets a tent in the parking lot to accommodate the swarms of people enjoying the dinner buffet, open bar, and live musical entertainment, all complimentary. Vegetarians can get their fill of broccoli, cauliflower, carrots, and crackers. Location: Borsheim’s, 120 Regency Parkway, Omaha NE 68114 [map], (800) 642-4438.

7:30 AM to 4:15 PM: Shop for products from dozens of Berkshire subsidiaries in the 194,300-square-foot hall next to the meeting area. The most crowded stores are usually those of See’s Candies, Fruit of the Loom, Bookworm, Justin Boots, and Brooks shoes.

7:30 AM to 4:15 PM: Shop for products from dozens of Berkshire subsidiaries in the 194,300-square-foot hall next to the meeting area. The most crowded stores are usually those of See’s Candies, Fruit of the Loom, Bookworm, Justin Boots, and Brooks shoes.

Meeting credentials are required to enter the CenturyLink Center for the Berkshire Hathaway meeting or the adjoining area to hit the stores of the many Berkshire subsidiaries. Meeting credentials are also required to get special shareholder pricing at Borsheims, Nebraska Furniture Mart, and other stores that might offer shareholder discounts.

Meeting credentials are required to enter the CenturyLink Center for the Berkshire Hathaway meeting or the adjoining area to hit the stores of the many Berkshire subsidiaries. Meeting credentials are also required to get special shareholder pricing at Borsheims, Nebraska Furniture Mart, and other stores that might offer shareholder discounts..jpg)

.jpg)

.jpg)

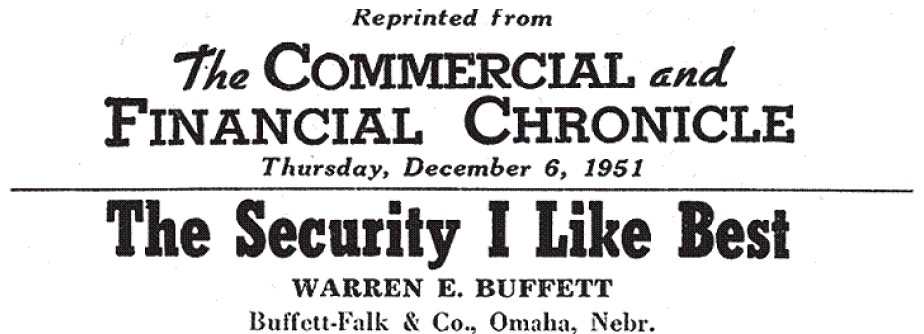

In the 06-Dec-1961 (Thursday) edition of

In the 06-Dec-1961 (Thursday) edition of  Berkshire Hathaway’s

Berkshire Hathaway’s

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

)

.jpg)