- If at first the idea is not absurd, then there is no hope for it.

— Albert Einstein (1879–1955), German-born Physicist & Philosopher, Author of Out of My Later Years - Every time you meet somebody, you’re looking for a better and newer and bigger idea. You are open to ideas from anywhere.

–Jack Welch (b. 1935), American Business Executive & Author of Jack: Straight From The Gut and Winning .jpg) The man with a new idea is a crank until the idea succeeds.

The man with a new idea is a crank until the idea succeeds.

–Mark Twain (1835–1910), American Author & Humorist, Author of Adventures of Huckleberry Finn- The rewards in business go to the man who does something with an idea.

–William Benton (1900–73), American Publisher, Businessman, Politician - Try this for a week: Each morning, spring out of bed at the first hint of light and focus first on the new and wondrous things that are just waiting to reveal themselves that day. Let curiosity well up inside of you. Let your mind open up to new ideas. Forget that you already know everything.

–Donna Kinni (b. 1961), American Author - The creative person wants to be a know-it-all. He wants to know about all kinds of things: ancient history, nineteenth-century mathematics, current manufacturing techniques, flower arranging, and hog futures. Because he never knows when these ideas might come together to form a new idea. It may happen six minutes later or six months or six years down the road. But he has faith that it will happen.

–Carl Ally (1924–99), American Advertising Executive - When it comes to organizational imagination, everyone is a point of light, inwardly afire with excellent ideas for making our companies work smarter, faster, leaner, and better. But as business leaders, we too seldom tap into our most valuable resource—the brain trust of our employees—to discover new pathways of progress and profits.

–Charles Decker (1961–2012), American Publisher - Inventors and men of genius have almost always been regarded as fools at the beginning (and very often at the end) of their careers.

–Feodor Dostoyevsky (1821–81), Russian novelist, Author of Crime and Punishment - Ideas are like rabbits. You get a couple and learn how to handle them, and pretty soon you have a dozen.

–John Steinbeck (1902–68), American Novelist and author of Of Mice and Men .jpg) Keep on the lookout for novel ideas that others have used successfully. Your idea has to be original only in its adaptation to the problem you’re working on.

Keep on the lookout for novel ideas that others have used successfully. Your idea has to be original only in its adaptation to the problem you’re working on.

–Thomas Edison (1847–1931), American Inventor- No idea is so antiquated that it was not once modern. No idea is so modern that it will not someday be antiquated.

–Ellen Glasgow (1873–1945), American Novelist, Author of In This Our Life - To stay ahead, you must have your next idea waiting in the wings.

–Rosabeth Moss Kanter (b. 1942), American Academic, Author of Challenge of Organizational Change - Brainpower is now the greatest commodity we can contribute to the world. Democracy was never intended to be a breeding place for mediocrity. We must engage in the business of stimulating brainpower lest we fail in producing leaders of consequence. In a period of speed, space and hemispheric spasms we dare not treat new thoughts as if they were unwelcome relatives.

–Dean F. Berkley (1925–2009), American Academic - If you do not express your own original ideas, if you do not listen to your own being, you will have betrayed yourself. Also, you will have betrayed your community in failing to make your contribution.

–Rollo May (1909–94), American Psychologist - New ideas come from differences. They come from having different perspectives and juxtaposing different theories.

–Nicholas Negroponte (b. 1943), Greek-American Architect - Invention is the process by which a new idea is discovered or created. In contrast, innovation occurs when a new idea is adopted.

–Everett Rogers (1931–2004), American Sociologist - The best way to have a good idea is to have a lot of ideas.

–Linus Pauling (1901–94), American Scientist - Ideas are a capital that bears interest only in the hands of talent.

–Antoine de Rivarol (1753–1801), French Journalist - The power of an idea can be measured by the degree of resistance it attracts.

–David Yoho (b. 1946), American Business Consultant - An idea is salvation by imagination.

–Frank Lloyd Wright (1869–1959), American Architect and author of The Natural House .jpg) Daring ideas are like chessmen moved forward. They may be beaten, but they may start a winning game.

Daring ideas are like chessmen moved forward. They may be beaten, but they may start a winning game.

–Johann Wolfgang von Goethe (1749–1832), German Poet & Statesman, Author of Maxims and Reflections- If you can dream it, you can do it.

–Walt Disney (1901–66), American Entrepreneur & Entertainer - There is no prosperity, trade, art, city, or great material wealth of any kind, but if you trace it home, you will find it rooted in a thought of some individual man.

–Ralph Waldo Emerson (1803–82), American Philosopher and Essayist, Author of Self-Reliance - A great idea is usually original to more than one discoverer. Great ideas come when the world needs them. Great ideas surround the world’s ignorance and press for admission.

–Elizabeth Stuart Phelps (1844-1911), American Author of A Singular Life and other books - I’d climb into the car as it went down the assembly line and introduce myself. Then I’d ask for ideas.

–John Risk, American Automotive Engineer

Category: Mental Models and Psychology

Bill Gates on Malcolm Gladwell’s 10,000 Hour Rule

It’s a tempting proposal: if you practice anything for 10,000 hours, then you will become world class. In 1993, scientist Anders Ericsson learned of a group of psychologists in Berlin who were researching violin players found that, by age 20, the leading performers had averaged in excess of 10,000 hours of practice each. Less able performers, in the meantime, clocked up just 4,000 hours. Malcolm Gladwell popularized the notion further in his book Outliers: The Story of Success.

It’s a tempting proposal: if you practice anything for 10,000 hours, then you will become world class. In 1993, scientist Anders Ericsson learned of a group of psychologists in Berlin who were researching violin players found that, by age 20, the leading performers had averaged in excess of 10,000 hours of practice each. Less able performers, in the meantime, clocked up just 4,000 hours. Malcolm Gladwell popularized the notion further in his book Outliers: The Story of Success.

In study after study, of composers, basketball players, fiction writers, ice-skaters, concert pianists, chess players, master criminals,” writes the neurologist Daniel Levitin, “this number comes up again and again. Ten thousand hours is equivalent to roughly three hours a day, or 20 hours a week, of practice over 10 years… No one has yet found a case in which true world-class expertise was accomplished in less time. It seems that it takes the brain this long to assimilate all that it needs to know to achieve true mastery.

Gladwell applied the concept to Bill Joy, Bill Gates, and the Beatles, who sharpened their musical know-how in performance at Hamburg’s strip clubs. Gladwell says:

The Beatles ended up travelling to Hamburg five times between 1960 and the end of 1962. On the first trip, they played 106 nights, of five or more hours a night. Their second trip they played 92 times. Their third trip they played 48 times, for a total of 172 hours on stage. The last two Hamburg stints, in November and December 1962, involved another 90 hours of performing. All told, they performed for 270 nights in just over a year and a half. By the time they had their first burst of success in 1964, they had performed live an estimated 1,200 times, which is extraordinary. Most bands today don’t perform 1,200 times in their entire careers. The Hamburg crucible is what set the Beatles apart.

.jpg) Coined by Florida State psychologist Anders Ericsson and made famous by Malcolm Gladwell in his book Outliers, the 10,000 hour rule reflects the belief that becoming a superlative athlete or performer rests on a long period of hard work rather than “innate ability” or talent. As stated by Malcolm Gladwell’s famous 10,000-hour rule, genuine success only comes to people who are willing to put in a great many hours to become first-class at something they value. Whether it involves learning a new piece of equipment, a new language, or developing a craft, being able to cope with setbacks and stay focused on goals regardless of how far-flung they seem. And so the importance of resolve and steadiness in success.

Coined by Florida State psychologist Anders Ericsson and made famous by Malcolm Gladwell in his book Outliers, the 10,000 hour rule reflects the belief that becoming a superlative athlete or performer rests on a long period of hard work rather than “innate ability” or talent. As stated by Malcolm Gladwell’s famous 10,000-hour rule, genuine success only comes to people who are willing to put in a great many hours to become first-class at something they value. Whether it involves learning a new piece of equipment, a new language, or developing a craft, being able to cope with setbacks and stay focused on goals regardless of how far-flung they seem. And so the importance of resolve and steadiness in success.

Bill Gates did not only have an propensity for creating software, he also had just about exceptional access as a schoolboy to a mainframe computer that the parents’ association of his local school invested in, in 1968. He got to it in eighth grade before just about anyone else in the world. Correspondingly the Beatles’ genius for melody did not come ready made. They developed it while singing in Hamburg in the early Sixties, at all-night strip clubs. In those years they dedicated more time to pop music than any of their peers. The same could be said for Mozart, or Tiger Woods. They had capability, sure enough, but they also had extraordinary family circumstances that allowed them a reasonable advantage at a very early age. They put the hours in first.

Extraordinary success depends on talent, hard work, and being in the right place at the right time, among other things. In Outliers, Gladwell contends that, to truly master any skill, leaning on various pieces of research, requires about 10,000 concentrated hours. If you can get those hours in early, and be in a position to exploit them, then you are an outlier.

When asked, “What do you think of Malcolm Gladwell’s theory that the years 1953 to 1955 were the perfect ones in which to be born for the computer revolution?” by his father William H. Gates Sr., Bill Gates reponds:

His book makes a lot of great points … that is that in all success stories there are significant elements of luck and tiny … I wasn’t the only kid born between 1953 and 1955, but absolutely to be young and open-minded at a time when the microprocessor was invented … in my case have a friend Paul Allen who was more open-minded about hardware type things and literally brought me the obscure article to talk about that first microprocessor and said you know this is going to improve exponentially … what does that mean and I said well at that means it we can do anything we want and then he was … you know … bugging me the rest of the time every time there’d be a new microprocessor he said can we do something yet and when we were in high school that can happen … so he came back to possible good job there and actually the microprocessor that was finally good enough came out in early 1975 and that’s why I i dropped out … so the timing was pretty important you know why didn’t older people see it … they weren’t this open open minded … they didn’t think about software is the key ingredient … now a lot of kids started doing software and … it’s not if somebody reads the book to say that if you spend 10,000 hours doing something you’ll be super good at it I don’t think that’quite as simple as that what you do is you do about 50 hours and ninety percent drop out because they don’t like it or they’re not good … you do another 50 hours and ninety percent drop out … so there’s these constant cycles and you do have to be lucky enough but also fanatical enough to keep going and so the person makes it to 10,000 hours is not just somebody has done it for 10,000 hours there’s somebody who chosen and been chosen in many different times and so all these magical things came together including who I know and that time … and i think you know that’s very important … when you look at somebody who’s good and say could I do it like them … they’ve gone through so many cycles that it may fool you that you know yes yes you could with the with the right luck, imagination, and and some some talent.

Bill Gates responds to Malcolm Gladwell’s theory that it takes 10,000 hours of deliberate practice to master a skill. Apart from acknowledging luck, timing and an open mind, Gates suggests that a successful person survives many cycles of attrition to make it to 10,000 hours of experience. “You do have to be lucky enough, but also fanatical enough to keep going,” explains Gates.

Unfortunately, a Princeton study, which analyzed 88 studies, established that practice accounted for just a 12% variation in performance.

Charlie Munger in Praise of Multidisciplinary Thinking

A multidisciplinary approach involves drawing appropriately from multiple disciplines to redefine problems outside of normal boundaries and reach solutions based on a new understanding of complex situations.

.jpg) From ‘Charlie Munger: The Complete Investor’ by Tren Griffin

From ‘Charlie Munger: The Complete Investor’ by Tren Griffin

No one can know everything, but you can work to understand the big important models in each discipline at a basic level so they can collectively add value in a decision-making process. Simply put, Munger believes that people who think very broadly and understand many different models from many different disciplines make better decisions and are therefore better investors.

Multidisciplinary thinking offers a schema or a philosophical template within which thinkers can find an intellectual connectedness to decompartmentalize their approach and face the new intellectual horizons with a broader perspective. Single disciplines are too narrow a perspective regarding many phenomena.

Human thought, as it has evolved in detached disciplines, and the physical systems within which we live exhibit a level of complexity across and within systems that makes it impossible to understand the important phenomena that are affecting humans today from the perspective of any single incomplete system of thought. Thus interconnected systems and high levels of complexity yield a situation in which multidisciplinary tactics to understanding and problem solving produce the real growth industry in the next generation of scholarly thought.

Disciplines develop their own internal ways of looking at the phenomena that interest them. Become broadly knowledgeable about any particular phenomenon as possible before constructing theories and asserting truth assertions. Problems arise from the lack of a viewpoint from which one can understand the relationship between various disciplines.

.jpg) In ‘Conceptual Foundations for Multidisciplinary Thinking’, Stanford’s Prof. Stephen Jay Kline expounds the necessity of multidisciplinary discourse:

In ‘Conceptual Foundations for Multidisciplinary Thinking’, Stanford’s Prof. Stephen Jay Kline expounds the necessity of multidisciplinary discourse:

Multidisciplinary discourse is more than just important. We can have a complete intellectual system, one that covers all the necessary territory, only if we add multidisciplinary discourse to the knowledge within the disciplines. This is true not only in principle but also for strong pragmatic reasons. This will assure the safety of our more global ideas.

Producing and applying knowledge no longer work within strict disciplinary boundaries. New dimensions of intricacy, scale, and uncertainty in technical problems put them beyond the reach of one-thought disciplines. Advances with the most impact are born at the frontiers of more than one engineering discipline.

Multidisciplinarity refers more to the internalization of knowledge. This happens when abstract associations are developed using an outlook in one discipline to transform a perspective in another or research techniques developed in one elaborate a theoretic framework in another.

To get the most out of their R&D workforce, many organizations seek persons who comprehend a range of science and engineering principles and procedures to guarantee that work will be advanced even if a specific expert were not always available.

When Ronald Reagan forgot about his adapted son Michael Reagan

In 1945, President Ronald Reagan and his first wife, the actress Jane Wyman adopted a son Michael E. Reagan. His adoption was not a happy one and he is now estranged from his family.

.jpg) ‘Reagan: The Life’ by H.W. Brands recalls Michael Raegan’s story, who as a child was “neglected as those of any famous parent. Invited to speak at his adopted son Michael’s boarding school, Reagan failed to recognise his boy under a mortar board. ‘My name is Ronald Reagan. What’s yours?’ he said. ‘Remember me?’ came the sad reply: ‘I’m your son Mike.'”

‘Reagan: The Life’ by H.W. Brands recalls Michael Raegan’s story, who as a child was “neglected as those of any famous parent. Invited to speak at his adopted son Michael’s boarding school, Reagan failed to recognise his boy under a mortar board. ‘My name is Ronald Reagan. What’s yours?’ he said. ‘Remember me?’ came the sad reply: ‘I’m your son Mike.'”

In 1964 Ronald Reagan was the commencement speaker at an exclusive preparatory school outside Scottsdale, Arizona. He was standing with several of the graduating seniors, who were invited to pose for pictures with him. He chatted to each of the graduates in turn, and to one of the boys said: “My name is Ronald Reagan. What’s yours?” The boy said, “I’m your son, Mike.” “Oh,” said Reagan. “I didn’t recognize you.”

Reagan and his first wife Wyman divorced in 1952. Michael Reagan was born in Los Angeles to Irene Flaugher, an unmarried woman from Kentucky who became pregnant through a relationship with U.S. Army corporal John Bourgholtzer. Michael Reagan is a conservative radio host and strategist for the American Republican party.

10 Ways to Improve Your Creative Imagination

If you want to develop your creative imagination you must open your mind to new unexplored paths, think of offbeat ways to tackle a problem, make something that is hard easier.

If you want to develop your creative imagination you must open your mind to new unexplored paths, think of offbeat ways to tackle a problem, make something that is hard easier.- Be curious about everything—the world is full of amazing wonders for you to learn about. They will become your storehouse of memories and ideas that you can use when needed.

- Look deep into the problem you face and imagine different alternatives for solving the problem. Try new paths— don’t accept the status-quo, if you fail at one task try another approach. Take everything with a grain of salt, keep an open mind.

- Try to associate with other creative people, people who discuss ideas.

- Always be on the lookout for new innovations that you can improve upon. When a new product, device or machine is invented it is already ripe for improving. Technology is always being improved. Just look at the automobile, since it was invented over a hundred years ago it has been constantly improved with thousands of new innovations added.

- This goes for any product, there is always room for improvement. Even if you come up with what seems to be a crazy way of solving a problem—write it down anyway—think about it—it may turn out to be a good idea.

- Start thinking about writing a story, think of a plot, think up characters for the story, take notes and expand the story over a period of time. Refine and change the story if you want to. Take your time, new ideas will pop out of your subconscious as you think about it. It is your creation you can do anything you want with it, use you imagination.

- Whether you are writing music or leading an army into battle keep your mind open for opportunities—new angles—different strategies—if one thing doesn’t work try another.

- Develop your interests and natural talents—follow these talents—be curious, learn as much as you can about subjects you are interested in and then improvise, develop, expand them. Follow different off beat paths. If they don’t work try another tack.

- Build upon the ideas of other people— improve and refine their ideas. It is the fundamental reason for human progress. It created the ‘Mind’ of mankind (the vast network of human minds that continually spread ideas across time and place).

Advantages and Disadvantages of Using Various Research Methods

Experimental Method

Advantages of Experimental Method:

- Precise control possible

Disadvantages of Experimental Method:

- Artificial setting typical

- Causal conclusions possible

- Intrusiveness typically high

- Precise measurement possible

- Complex behaviors difficult to measure

- Theory testing possible

- Unstructured exploratory research difficult

Correlational Observation

Advantages of Correlational Observation:

- Relationships between variables can be found

Disadvantages of Correlational Observation:

- Causal conclusions impossible

- Precise measurement usually possible

- Control of variables difficult

- Intrusiveness usually low

- Many participants required

Ethnography

Advantages of Ethnography:

- Unfamiliar situations can be described

Disadvantages of Ethnography:

- Control of variables impossible

- Complex behaviors can be described

- Precise measurement difficult

- Intrusiveness low

- Investigator bias possible

- Participants treated humanistically

- Causal conclusions impossible

Questionnaires

Advantages of Questionnaires:

- Data collection efficient

Disadvantages of Questionnaires:

- Causal conclusions impossible

- Attitude or opinion can be measured

- Self-reports difficult to verify

- Unbiased sample selection difficult

- Response rates low when mailed

Naturalistic Observation

Advantages of Naturalistic Observation:

- Realistic setting helps generalization

Disadvantages of Naturalistic Observation:

- Control of variables impossible

- Intrusiveness low

- Data collection inefficient

- Investigator bias possible

Archival Research

Advantages of Archival Research:

- No additional data collection required

Disadvantages of Archival Research:

- Causal conclusions impossible

- Rare behaviors can be studied

- Appropriate records often not available

- Nonmanipulable events can be studied

- Data collected by nonscientists

- Data usually correlational at best

Case History

Advantages of Case History:

- Rare cases can bestudied

Disadvantages of Case History:

- Control of variables impossible

- Complex behavior can be intensively studied

- Data often based on fallible memories

- Investigator bias highly likely

- Causal conclusions impossible

Three Types of Hedonism

Hedonism is a broad category of philosophical though that encompasses any system that places “pleasure” as being the intrinsic good, or the only thing that is considered good by itself independent of all other things.

Hedonism is the philosophical principle that places pleasure and gratification as the intrinsic good. In other words, pleasure and gratification are the only things that can be deemed good by themselves independent of all other things.

There are three distinct types of hedonism differentiated by proponents of the doctrine that enjoyment is the good:

- Psychological Hedonism: Pleasure is the solitary possible purpose of desire or pursuit. This may be held on observational bases, or be thought to be dictated by the significance of ‘desire.’

- Evaluative Hedonism: Pleasure is what we are supposed to desire and pursue.

- Rationalizing Hedonism: Pleasure is the only object that makes a pursuit sensible.

References

Consequences of Organizational Commitment Level for Individual Employees and an Organization

Like various social groups at different times throughout history, organizations and corporations developed distinctive cultures.

Organizational culture is the entirety of socially transmitted behavior patterns that are typical of a particular organization or a company. Organizational culture encompasses the structure of the organization and the roles within it, the leadership style, the prevailing values, norms, sanctions, and support mechanisms, and the past traditions and folklore, methods of enculturation, and characteristic ways of interacting with people and institutions outside of the culture (such as customers, suppliers, the competition, government agencies, and the general public).

Consequences of Organizational Commitment Level for Individual Employees

- Low Organizational Commitment: Potentially positive consequences for opportunity for expression of originality and innovation, but an overall negative effect on career advancement opportunities

- Moderate Organizational Commitment: Enhanced feeling of belongingness and security, along with doubts about the opportunity for advancement

- High Organizational Commitment: Greater opportunity for advancement and compensation for efforts, along with less opportunity for personal growth and potential for stress in family relationships

Consequences of Organizational Commitment Level for the Organization

- Low Organizational Commitment: Absenteeism, tardiness, workforce turnover, and poor quality of work

- Moderate Organizational Commitment: As compared with low commitment, less absenteeism, tardiness, turnover, and better quality of work, as well as increased level of job satisfaction

- High Organizational Commitment: Potential for high productivity, but sometimes accompanied by lack of critical/ethical review of employee behavior and by reduced organizational flexibility

Companies need to engage their employees to capitalize on emotional energy and consistently achieve higher levels of performance than their competition. It’s critical for leaders to do their best to gain effective commitment, and reduce their teams’ reliance on continuance and normative commitment, so that they lead teams of employees who feel passionate for their roles in the organization.

Conducting Behavioral Assessments: Advantages

Behavioral assessments ask specific questions focused on target behaviors. Behavioral assessments are interested in samples of behavior and not behavior as a sign of internal processes. The responses collected from behavioral assessments can be interpreted as samples of a person behavior that are thought to generalize to other situations that the person might be subject to.

Overall, data and information resulting from behavioral assessments may have numerous advantages over data and information derived by traditional assessments or other methods of assessments. Data derived from behavioral assessments can be used:

- to present behavioral baseline data with which other behavioral data (gathered after the passage of time, after a particular intervention, or after some other event) can be compared

- to make available a record of the subject’s behavioral strengths and weaknesses across a assortment of situations, circumstances, and settings that the subject can be exposed to

- to identify and pin down environmental circumstances that act to trigger, maintain, or extinguish certain behaviors in the subject

- to identify and target precise behavioral patterns in a subject for modification through clinical or psychological interventions

- to produce graphic displays that can be used to encourage inventive methods of treatment or more effective clinical or psychological therapy methods

The level of training and the experience of assessors influence the validity and reliability of behavioral assessments. Also affecting the soundness of the behavioral interviews is the ability to generalize the observations to other subjects, settings, and situations.

Warren Buffett in 1951: “The Security I Like Best:” GEICO

.jpg)

In his 2013 annual letter to Berkshire Hathaway Shareholders, Warren Buffet extols his mentor Ben Graham’s discourse on value investing, “The Intelligent Investor.” Warren has previously described The Intelligent Investor as “by far the best book on investing ever written.”

I learned most of the thoughts in this investment discussion from Ben’s book The Intelligent Investor, which I bought in 1949. My financial life changed with that purchase.

And:

A couple of interesting sidelights about the book: Later editions included a postscript describing an unnamed investment that was a bonanza for Ben. Ben made the purchase in 1948 when he was writing the first edition and—brace yourself—the mystery company was GEICO. If Ben had not recognized the special qualities of GEICO when it was still in its infancy, my future and Berkshire’s would have been far different.

And,

When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the company enjoyed compared to the expenses borne by the giants of the industry. That operational efficiency continues today and is an all-important asset. No one likes to buy auto insurance. But almost everyone likes to drive. The insurance needed is a major expenditure for most families. Savings matter to them—and only a low-cost operation can deliver these.

Warren Buffett’s 1951 Analysis Article: “The Security I Like Best”: GEICO

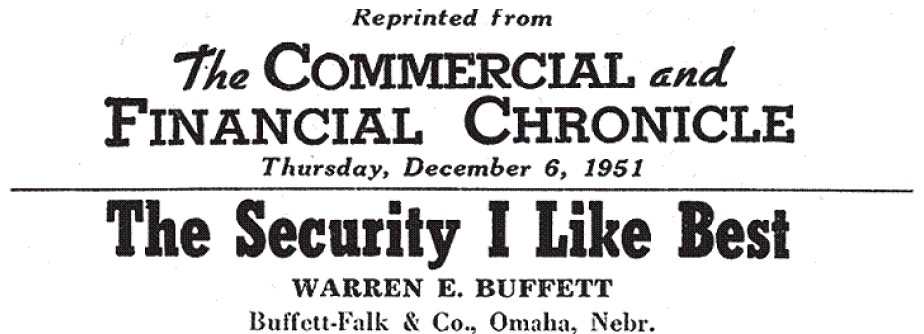

In the 06-Dec-1961 (Thursday) edition of The Commercial and Financial Chronicle, a weekly business newspaper in the United States, Warren Buffett published an article on his analysis of the GEICO stock. He described GEICO, Government Employees Insurance Company, as the “The Security I Like Best.” Warren E. Buffett was then the principal of Omaha, NE, Buffett-Falk & Co. Below is a copy of Warren’s article; a facsimile of the article is also available in the PDF format: Warren_Buffett_-_The_Security_I_Like_Best.pdf.

In the 06-Dec-1961 (Thursday) edition of The Commercial and Financial Chronicle, a weekly business newspaper in the United States, Warren Buffett published an article on his analysis of the GEICO stock. He described GEICO, Government Employees Insurance Company, as the “The Security I Like Best.” Warren E. Buffett was then the principal of Omaha, NE, Buffett-Falk & Co. Below is a copy of Warren’s article; a facsimile of the article is also available in the PDF format: Warren_Buffett_-_The_Security_I_Like_Best.pdf.

This article is educational because it clearly shows the considerations that Buffett used to probe the company and evaluate its stock. The way of thinking of how Buffett and Berkshire Hathaway came to own GEICO provides a pattern of how to find and research any investment.

The Security I Like Best: The Government Employees Insurance Co. (GEICO)

Full employment, boom time profits and record dividend payments do not set the stage for depressed security prices. Most industries have been riding this wave of prosperity during the past five years with few ripples to disturb the tide.

The auto insurance business has not shared in the boom. After the staggering losses of the immediate postwar period, the situation began to right itself in 1949. In 1950, stock casualty companies again took it on the chin with underwriting experience the second worst in 15 years. The recent earnings reports of casualty companies, particularly those with the bulk of writings in auto lines, have diverted bull market enthusiasm from their stocks. On the basis of normal earning power and asset factors, many of these stocks appear undervalued.

The nature of the industry is such as to ease cyclical bumps. The majority of purchasers regards auto insurance as a necessity. Contracts must be renewed yearly at rates based upon experience. The lag of rates behind costs, although detrimental in a period of rising prices as has characterized the 1945-1951 period, should prove beneficial if deflationary forces should be set in action.

Other industry advantages include lack of inventory, collection, labor and raw material problems. The hazard of product obsolescence and related equipment obsolescence is also absent.

Government Employees Insurance Corporation was organized in the mid-30’s to provide complete auto insurance on a nationwide basis to an eligible class including: (1) Federal, State and municipal government employees; (2) active and reserve commissioned officers and the first three pay grades of non-commissioned officers of the Armed Forces; (3) veterans who were eligible when on active duty; (4) former policyholders; (5) faculty members of universities, colleges and schools; (6) government contractor employees engaged in defense work exclusively, and (7) stockholders.

The company has no agents or branch offices. As a result, policyholders receive standard auto insurance policies at premium discounts running as high as 30% off manual rates. Claims are handled promptly through approximately 500 representatives throughout the country.

The term “growth company” has been applied with abandon during the past few years to companies whose sales increases represented little more than inflation of prices and general easing of business competition. GEICO qualifies as a legitimate growth company based upon the following record:

Year— Premiums Written Policy Holders 1936 $103,696.31 3,754 1940 768,057.86 25,514 1945 1,638,562.09 51,697 1950 8,016,975.79 143,944 Of course the investor of today does not profit from yesterday’s growth. In GEICO’s case, there is reason to believe the major portion of growth lies ahead. Prior to 1950, the company was only licensed in 15 of 50 jurisdictions including D. C. and Hawaii. At the beginning of the year there were less than 3,000 policyholders in New York State. Yet 25% saved on an insurance bill of $125 in New York should look bigger to the prospect than the 25% saved on the $50 rate in more sparsely settled regions.

As cost competition increases in importance during times of recession, GEICO’s rate attraction should become even more effective in diverting business from the brother-in-law. With insurance rates moving higher due to inflation, the 25% spread in rates becomes wider in terms of dollars and cents.

There is no pressure from agents to accept questionable applicants or renew poor risks. In States where the rate structure is inadequate, new promotion may be halted.

Probably the biggest attraction of GEICO is the profit margin advantage it enjoys. The ratio of underwriting profit to premiums earned in 1949 was 27.5% for GEICO as compared to 3.7% for the 135 stock casualty and surety companies summarized by Best’s. As experience turned for the worse in 1950, Best’s aggregate’s profit margin dropped to 3.0% and GEICO’s dropped to 13.0%. GEICO does not write all casualty lines; however, bodily injury and property damage, both important lines for GEICO, were among the least profitable lines. GEICO also does a large amount of collision writing, which was a profitable line in 1950.

During the first half of 1951, practically all insurers operated in the red on casualty lines with bodily injury and property damage among the most unprofitable. Whereas GEICO’s profit margin was cut to slightly above 9%, Massachusett’s Bonding & Insurance showed a 26% loss, New Amsterdam Casualty an 8% loss, Standard Accident Insurance a 9% loss, etc.

Because of the rapid growth of GEICO, cash dividends have had to remain low. Stock dividends and a 25-for-1 split increased the outstanding shares from 3,000 on June 1, 1948, to 250,000 on Nov. 10, 1951. Valuable rights to subscribe to stock of affiliated companies have also been issued.

Benjamin Graham has been Chairman of the Board since his investment trust acquired and distributed a large block of the stock in 1948. Leo Goodwin, who has guided GEICO’s growth since inception, is the able President. At the end of 1950, the 10 members of the Board of Directors owned approximately one third of the outstanding stock.

Earnings in 1950 amounted to $3.92 as contrasted to $4.71 on the smaller amount of business in 1949. These figures include no allowance for the increase in the unearned premium reserve which was substantial in both years. Earnings in 1953 will be lower than 1950, but the wave of rate increases during the past summer should evidence themselves in 1952 earnings. Investment income quadrupled between 1947 and 1950, reflecting the growth of the company’s assets.

At the present price of about eight times the earnings of 1950, a poor year for the industry, it appears that no price is being paid for the tremendous growth potential of the company.

In 1951, Warren Buffett made his first purchase of GEICO stock. In 1996, Warren Buffett purchased all outstanding stock of GEICO, and folded GEICO into the Berkshire Hathaway umbrella as a subsidiary company. GEICO is part of the most noteworthy of Berkshire Hathaway’s businesses: the insurance business.

Insurance ‘Float’: A Significant Enabler of Berkshire Hathaway’s Success

Berkshire Hathaway’s insurance operations provides Warren Buffett the ‘float’ that has been critical to his success as an investor. This float is money that Berkshire Hathaway holds to pay insurance claims at some point in the future, but in the intervening time can be put to work in stocks and long-term investments that earn returns for Berkshire. In effect, float constitutes borrowed funds at little or no cost. It enables Berkshire Hathaway to purchase businesses and assets beyond what Berkshire Hathaway’s cash and capital would allow. Other than GEICO, Berkshire Hathaway’s major insurance operations include Berkshire Hathaway Reinsurance Group and General Re.

Berkshire Hathaway’s insurance operations provides Warren Buffett the ‘float’ that has been critical to his success as an investor. This float is money that Berkshire Hathaway holds to pay insurance claims at some point in the future, but in the intervening time can be put to work in stocks and long-term investments that earn returns for Berkshire. In effect, float constitutes borrowed funds at little or no cost. It enables Berkshire Hathaway to purchase businesses and assets beyond what Berkshire Hathaway’s cash and capital would allow. Other than GEICO, Berkshire Hathaway’s major insurance operations include Berkshire Hathaway Reinsurance Group and General Re.

GEICO is today the second largest auto insurer in the United States. GEICO’s mascot is a Gold dust day gecko with a Cockney accent. GEICO is well known in popular culture for its advertising, having made a large number of commercials that aim to amuse viewers. The GEICO gecko is voiced by English actor Jake Wood.