If you want to develop your creative imagination you must open your mind to new unexplored paths, think of offbeat ways to tackle a problem, make something that is hard easier.

If you want to develop your creative imagination you must open your mind to new unexplored paths, think of offbeat ways to tackle a problem, make something that is hard easier.- Be curious about everything—the world is full of amazing wonders for you to learn about. They will become your storehouse of memories and ideas that you can use when needed.

- Look deep into the problem you face and imagine different alternatives for solving the problem. Try new paths— don’t accept the status-quo, if you fail at one task try another approach. Take everything with a grain of salt, keep an open mind.

- Try to associate with other creative people, people who discuss ideas.

- Always be on the lookout for new innovations that you can improve upon. When a new product, device or machine is invented it is already ripe for improving. Technology is always being improved. Just look at the automobile, since it was invented over a hundred years ago it has been constantly improved with thousands of new innovations added.

- This goes for any product, there is always room for improvement. Even if you come up with what seems to be a crazy way of solving a problem—write it down anyway—think about it—it may turn out to be a good idea.

- Start thinking about writing a story, think of a plot, think up characters for the story, take notes and expand the story over a period of time. Refine and change the story if you want to. Take your time, new ideas will pop out of your subconscious as you think about it. It is your creation you can do anything you want with it, use you imagination.

- Whether you are writing music or leading an army into battle keep your mind open for opportunities—new angles—different strategies—if one thing doesn’t work try another.

- Develop your interests and natural talents—follow these talents—be curious, learn as much as you can about subjects you are interested in and then improvise, develop, expand them. Follow different off beat paths. If they don’t work try another tack.

- Build upon the ideas of other people— improve and refine their ideas. It is the fundamental reason for human progress. It created the ‘Mind’ of mankind (the vast network of human minds that continually spread ideas across time and place).

Tag: Thought Process

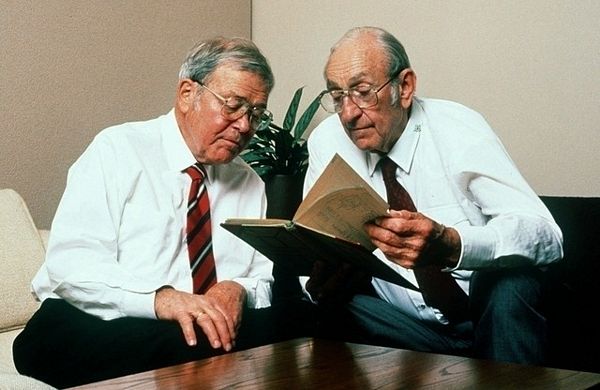

Books Recommended by Berkshire Hathaway’s Charlie Munger

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time—none, zero. You’d be amazed at how much Warren reads—at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

— Charlie Munger

Charlie Munger is Warren Buffett’s partner and Vice-Chairman at Berkshire Hathaway, the investment conglomerate. In his capacity, Munger has been a behind-the-scenes co-thinker at Berkshire and has influenced many a decision made by Warren Buffett.

Charlie Munger is Warren Buffett’s partner and Vice-Chairman at Berkshire Hathaway, the investment conglomerate. In his capacity, Munger has been a behind-the-scenes co-thinker at Berkshire and has influenced many a decision made by Warren Buffett.

At the 2004 annual meeting of Berkshire Hathaway, Charlie Munger said,

“We read a lot. I don’t know anyone who’s wise who doesn’t read a lot. But that’s not enough: You have to have a temperament to grab ideas and do sensible things. Most people don’t grab the right ideas or don’t know what to do with them.”

— Charlie Munger

Munger was chair of Wesco Financial Corporation from 1984 through 2011. He is also the chair of the Daily Journal Corporation, based in Los Angeles, California, and a director of Costco Wholesale Corporation. Unlike Warren Buffett, Charlie Munger has claimed that he is a generalist for whom investment is only one of a broad range of interests that include architecture, philosophy, philanthropy, investing, yacht-design, etc.

Charlie Munger is a voracious reader and engages in books on history, science, biography and psychology. He once said, “In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time—none, zero. You’d be amazed at how much Warren reads—at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

At the 2014 annual meeting of The Daily Journal Company that Charlie Munger leds as Chairman, Charlie said,

“I’m very selective. I, sometimes, skim. I, sometimes, read one chapter and I sometimes read the damn thing twice. It’s been my experience in life [that] if you just keep thinking and reading, you don’t have to work.”

Charlie Munger’s Book Recommendations in Biography

.jpg) Titan: The Life of John D. Rockefeller, Sr. by Ron Chernow

Titan: The Life of John D. Rockefeller, Sr. by Ron Chernow- Martians of Science: Five Physicists Who Changed the Twentieth Century by Istvan Hargittai

- The Path to Power (The Years of Lyndon Johnson, Volume 1) by Robert A. Caro

- Andrew Carnegie by Joseph Frazier Wall

- Damn Right: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger by Janet Lowe

- Benjamin Franklin by Carl Van Doren

- Einstein: His Life and Universe by Walter Isaacson

- Benjamin Franklin: An American Life by Walter Isaacson

Charlie Munger’s Book Recommendations in Biology

.jpg) The Selfish Gene by Richard Dawkins

The Selfish Gene by Richard Dawkins- Genome: The Autobiography of a Species in 23 Chapters by Matt Ridley

- A Matter of Degrees: What Temperature Reveals about the Past and Future of Our Species, Planet, and Universe by Gino Segre

- Ice Age: The Theory That Came In From The Cold! by John and Mary Gribbin

- The Third Chimpanzee: The Evolution and Future of the Human Animal by Jared Diamond

- The Language Instinct: How the Mind Creates Language by Steven Pinker

- Darwin’s Blind Spot: Evolution Beyond Natural Selection by Frank Ryan

- The Origin of Species by Charles Darwin

Charlie Munger’s Book Recommendations in Business & Investing

.jpg) Fiasco: The Inside Story of a Wall Street Trader by Frank Partnoy

Fiasco: The Inside Story of a Wall Street Trader by Frank Partnoy- Fortune’s Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street by William Poundstone

- The Wealth and Poverty of Nations: Why Some Are So Rich and Some So Poor by David S. Landes

- The Warren Buffett Portfolio: Mastering the Power of the Focus Investment Strategy by Robert G. Hagstrom

- Master of the Game: Steve Ross and the Creation of Time Warner by Connie Bruck

Charlie Munger’s Book Recommendations in Management & Leadership

.jpg) Poor Charlie’s Almanack The Wit and Wisdom of Charles T. Munger by Charles T. Munger

Poor Charlie’s Almanack The Wit and Wisdom of Charles T. Munger by Charles T. Munger- Getting It Done: How to Lead When You’re Not in Charge by Roger Fisher

- Models of My Life by Herbert A. Simon

- Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company by Andrew S. Grove

- Seeking Wisdom: From Darwin to Munger by Peter Bevelin

- Les Schwab Pride in Performance: Keep It Going by Les Schwab

Charlie Munger’s Book Recommendations in Philosphy & Psychology

.jpg) Deep Simplicity: Bringing Order to Chaos and Complexity by John Gribbin

Deep Simplicity: Bringing Order to Chaos and Complexity by John Gribbin- Judgment in Managerial Decision Making by Max H. Bazerman

- Conspiracy of Fools: A True Story by Kurt Eichenwald

- Three Scientists and Their Gods: Looking for Meaning in an Age of Information by Robert Wright

- Yes!: 50 Scientifically Proven Ways to Be Persuasive by Robert B. Cialdini

- Influence: The Psychology of Persuasion by Robert B. Cialdini

- Man’s Search For Meaning by Viktor E. Frankl

Charlie Munger’s Book Recommendations in Sociology

.jpg) Living within Limits: Ecology, Economics, and Population Taboos by Garrett James Hardin

Living within Limits: Ecology, Economics, and Population Taboos by Garrett James Hardin- Guns, Germs, and Steel: The Fates of Human Societies by Jared Diamond

- The Blind Watchmaker: Why the Evidence of Evolution Reveals a Universe without Design by Richard Dawkins

Advantages and Disadvantages of Using Various Research Methods

Experimental Method

Advantages of Experimental Method:

- Precise control possible

Disadvantages of Experimental Method:

- Artificial setting typical

- Causal conclusions possible

- Intrusiveness typically high

- Precise measurement possible

- Complex behaviors difficult to measure

- Theory testing possible

- Unstructured exploratory research difficult

Correlational Observation

Advantages of Correlational Observation:

- Relationships between variables can be found

Disadvantages of Correlational Observation:

- Causal conclusions impossible

- Precise measurement usually possible

- Control of variables difficult

- Intrusiveness usually low

- Many participants required

Ethnography

Advantages of Ethnography:

- Unfamiliar situations can be described

Disadvantages of Ethnography:

- Control of variables impossible

- Complex behaviors can be described

- Precise measurement difficult

- Intrusiveness low

- Investigator bias possible

- Participants treated humanistically

- Causal conclusions impossible

Questionnaires

Advantages of Questionnaires:

- Data collection efficient

Disadvantages of Questionnaires:

- Causal conclusions impossible

- Attitude or opinion can be measured

- Self-reports difficult to verify

- Unbiased sample selection difficult

- Response rates low when mailed

Naturalistic Observation

Advantages of Naturalistic Observation:

- Realistic setting helps generalization

Disadvantages of Naturalistic Observation:

- Control of variables impossible

- Intrusiveness low

- Data collection inefficient

- Investigator bias possible

Archival Research

Advantages of Archival Research:

- No additional data collection required

Disadvantages of Archival Research:

- Causal conclusions impossible

- Rare behaviors can be studied

- Appropriate records often not available

- Nonmanipulable events can be studied

- Data collected by nonscientists

- Data usually correlational at best

Case History

Advantages of Case History:

- Rare cases can bestudied

Disadvantages of Case History:

- Control of variables impossible

- Complex behavior can be intensively studied

- Data often based on fallible memories

- Investigator bias highly likely

- Causal conclusions impossible

The Best Tweets by Career Coach Marty Nemko: Life Lead Well & Career Success

Marty Nemko is an Oakland, CA-based career coach, and author. Marty hosts the “Work with Marty Nemko” on KALW-FM, an NPR-San Francisco station.

.jpg) Marty Nemko blogs about career, education, men’s and boys’ issues, the life well-led, and improving the world at martynemko.blogspot.com/. A compilation of his articles and writings are at www.martynemko.com/. His YouTube channel is at www.youtube.com/user/mnemko.

Marty Nemko blogs about career, education, men’s and boys’ issues, the life well-led, and improving the world at martynemko.blogspot.com/. A compilation of his articles and writings are at www.martynemko.com/. His YouTube channel is at www.youtube.com/user/mnemko.

Marty also published a compilation of his articles in newspapers, blogs, magazines, and on his website in book chock full of wisdom: ‘How to Do Life: What they didn’t teach you in school’.

Here are the very best of Marty Nemko’s tweets from his @MartyNemko handle.

- “I even take care to tear-off single sheets of toilet paper. Because I’m cheap? No. Because it’ll help the environment? No. I just think wasting is wrong.”

- “If you relentlessly pursue a big goal with laser-beam focus, you will likely like your life and be a most worthy person.”

- “Where at all ethically possible, we must give others hope. Without it, a person figuratively or even literally dies.”

- “Exploring what your parents did to you may provide insight but, often, your life is no better. It just legitimizes your malaise, maybe even increases your stuckness..”

- “Facing our parents’ aging forces us to confront our own mortality. It reminds us to appreciate and live each moment wisely.”

- “Keep it simple: Reasonable diets all distill to: Lots of vegetables and legumes, some fruit, and small portions of everything else.”

- “Be kind where you can, tough where you should.”

- “If you have a clearly good idea, to avoid getting talked out of it, get input only on how to better execute it.”

- “As we age, we may accrue a creeping bitter wisdom.”

- “Telling people I can’t lose weight may make me eat more—to prove myself right. Perhaps if I told people, “‘I’m gonna lose 20.'””

- “There’s cost and benefit each time you criticize or suggest. Sometimes, it’s worth the price. Make the choice consciously.”

- “That a partner ‘gets’ you, this is what above all cements love: love as accurate (but still benevolent) interpretation.”

- “A desire to “give back” needn’t imply giving to the neediest. It could mean giving to those with the most potential to benefit.”

- “We dun perfectionism, e.g., as causing procrastination. Yet haven’t your perfectionist efforts yielded the most good & satisfaction?”

- “A mantra to cure procrastinators: It needn’t be perfect; it needn’t be fun; it just has to get done.”

- “Far better than a course is self-study + a tutor to get you past your trouble spots.”

- “Far more of life’s pleasures are in the process than in the outcome. Be in the moment.“

- “Whatever bad awaits, don’t let it spoil the present moment.”

- “Scratch the surface of any thinking ideologue and you’ll find doubts. Ask, “Ever wondered whether the other side might be right?””

- “Might you be wise to focus more on self-acceptance than self-improvement? That might even motivate you to self-improve.”

- “More than a little “processing” of past bad experiences is often counterproductive.”

- “No matter how brilliant you are, if your style is too intense, most people will dismiss you.”

- “It’s easy to be liked: listen more than talk, praise often, and disagree rarely. The question is, is it worth the loss of integrity? “

- “Long-winded? Constantly ask yourself, “Does the person really need & want to know this phrase?” And keep utterances to <30 sec.”

- “I used to think most people are intrinsically motivated to work hard. But I’m finding that many if not most people need monitoring.”

- “The key to a well-led life is maxing your contribution. Happiness, less key, is most likely found in simple pleasures.”

- “How feeble are we that we’re swayed more by dubious flattery than by valid suggestions.”

- “Key to being liked: While retaining integrity, do more agreeing, amplifying, empathizing. do less arguing, one-upping, yes-butting.”

- “Why do so many people prefer a silly, manipulative, games-playing, selfish hottie over an ugly, intense, honest, kind person?”

- “It all comes down to this: Do good.“

- “You’ll likely learn more of enduring value from an hour of wise googling than from any course.”

- “Part of getting older may mean having to accept that we may not make as big a difference in the world as we had hoped.”

- “For many people, before age 60, it’s business before pleasure. After 60, pleasure before business.”

- “To boost self-esteem: accept you’re flawed like everyone, do what you’re good at, & accomplish: Even little wins boost self-esteem.”

- “A clue to what career or avocation you should pursue is to inventory how you actually spend your discretionary time.”

- “If you’ve been beaten up in Rounds 1-9, it’s hard to come out for Round 10.”

- “It’s hard to change people’s work style: aggressive vs passive, hardworking vs moderate. So it may be wise to praise their status-quo.”

- “Many people can do well in school, even get PhDs, yet are unhireable in the real world. The degree is US’s most overrated product.”

- “A resume rarely helps—it’s too filled with chemistry-inhibiting cliche. Write & tell the “resume” that’d reveal your true story & self.”

- “Be tough where you must be, kind where you can be.”

- “You can do everything right and still fail, not just once, but overall in life. Luck is more important than we acknowledge.”

- “A clue to what career you should pursue: When you’re really comfortable, what do you love to talk about?”

- “If you want to lock in a new attitude or behavior, say and/or write that and why. Then keep paraphrasing, NOT reading it.”

- “Before making an argument, ask a likely opponent to lay out the counterargument. Your argument can then incorporate that.”

- “In your desire to stand out from the horde, beware of hyping yourself, your ideas, or taking inappropriately extreme positions.”

- “Giving advice makes the recipient feel less efficacious, so weigh that against the benefit your advice will likely yield.”

- “Unefficacious people can’t or CHOOSE TO not bounce back—it’s a good excuse to avoid facing their inefficacy yet again.”

- ” Teamwork is deified. Don’t forget the pluses of individualism: more motivation, bolder/less compromised solutions, speed.”

- “When overwhelmed, after doing any needed planning, just stay in the moment and put one foot in front of the other.”

- “If your self-esteem is low, perhaps focus on finding work you can succeed at. Real self-esteem comes from accomplishment.”

- “If someone smiles at you with pursed lips, they’re generally forcing the smile—either because they’re shy or don’t like you.”

- “Wasting money on designer labels is so 20th-century. It’s a permanent loss of money in exchange an evanescent feel-good.”

- “Don’t confuse tact with cowardice. Sometimes, it’s wise to speak up boldly.”

- “Talking too much is a career killer. Keep all utterances to less than 45 seconds &, in dialogue, speak a bit LESS than 50% of the time.”

- “School can give a false sense of confidence or of loserhood. Too often, school success does not predict life success.”

- “Your goal must not be to impress but to accomplish. That usually demands bringing out the best in others.

- “Just because you CAN prove someone wrong, doesn’t mean you should.”

- “I fear we’ll make everything equal until everyone has nothing.”

- “To boost motivation: what’s your next 1-second task? It feels good to get even a tiny task done, make progress, and maybe learn something.”

- “To disagree without creating enmity: “I can see why you’d X. (explain.) And (not but) I’m wondering if Y. What do you think?””

- “In managing & parenting, praise when you can, & when you can’t, try invoking guilt, e.g., “I know you’re better than this.””

- “The most powerful motivator may not be fear—people go back to bad habits after a heart attack. Could it be proving themselves right?”

- “As we age, there’s a creeping bitter wisdom we accrue.”

- “When you think you can nail someone with your argument, take a breath & see if you can phrase it as a face-saving question.”

- “Some people are nice as a way of compensating for their not being good.”

- “If possible, slightly under-schedule yourself. That gives you the time to make your work higher-quality.”

- “Ever get tired of being nice? Tempted to throw caution to the wind and say what you really think? If deserved, even yell? “

- “Winners do not let themselves succumb to anything. They distract themselves by immersing themselves in their most engaging work.”

- “Good conversationalists choose a topic that enables each participant to contribute. “

- “It worked for me, it can work for you books aren’t helpful because typical readers are less smart & driven than book authors.”

- “To broaden your horizons, mix with people other than people from your own background (professional, cultural, social, academic, racial, ethnic, etc.) Most people prefer the company of other people from similar backgrounds. Birds of a feather do flock together.”

- “Most of us think ourselves bold, individualistic thinkers when in fact we’re tepid if not downright lemmings.”

- “Good, simple conversation starter, “What’s doing in your life?” or “Whatcha been thinking about these days?””

- “What skill of yours has given you the must success? Use it more.”

- “The most valuable way to spend a dollar? A memo pad. Keep it with you at all times. Think of ideas. Write them down. Implement them.”

- “Successful, productive people fuel themselves with their work & accomplishment, unsuccessful people through recreation.”

- “The desire to be right usually trumps the desire for truth.”

- “The only God resides within us: It is our our wisest attitudes and actions.”

- “We hear stories of persistence rewarded yet for each of those, hundreds have pressed on only to end up broken and/or broke.”

- “If the risk/reward ratio of taking an action is good, even if you may fail, it’s usually wise to follow Nike’s advice: Just do it!”

- “Sometimes, a problem has both a rational and an irrational component. It may help to try to solve those separately.”

- “People see counselors when they could journal on their own. People take classes when they could read on their own. Why? They’re forced to act.”

- “Don’t give up prematurely. Your continued efforts will iterate, improve based on lessons learned from your past failures.”

Warren Buffett in 1951: “The Security I Like Best:” GEICO

.jpg)

In his 2013 annual letter to Berkshire Hathaway Shareholders, Warren Buffet extols his mentor Ben Graham’s discourse on value investing, “The Intelligent Investor.” Warren has previously described The Intelligent Investor as “by far the best book on investing ever written.”

I learned most of the thoughts in this investment discussion from Ben’s book The Intelligent Investor, which I bought in 1949. My financial life changed with that purchase.

And:

A couple of interesting sidelights about the book: Later editions included a postscript describing an unnamed investment that was a bonanza for Ben. Ben made the purchase in 1948 when he was writing the first edition and—brace yourself—the mystery company was GEICO. If Ben had not recognized the special qualities of GEICO when it was still in its infancy, my future and Berkshire’s would have been far different.

And,

When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the company enjoyed compared to the expenses borne by the giants of the industry. That operational efficiency continues today and is an all-important asset. No one likes to buy auto insurance. But almost everyone likes to drive. The insurance needed is a major expenditure for most families. Savings matter to them—and only a low-cost operation can deliver these.

Warren Buffett’s 1951 Analysis Article: “The Security I Like Best”: GEICO

In the 06-Dec-1961 (Thursday) edition of The Commercial and Financial Chronicle, a weekly business newspaper in the United States, Warren Buffett published an article on his analysis of the GEICO stock. He described GEICO, Government Employees Insurance Company, as the “The Security I Like Best.” Warren E. Buffett was then the principal of Omaha, NE, Buffett-Falk & Co. Below is a copy of Warren’s article; a facsimile of the article is also available in the PDF format: Warren_Buffett_-_The_Security_I_Like_Best.pdf.

In the 06-Dec-1961 (Thursday) edition of The Commercial and Financial Chronicle, a weekly business newspaper in the United States, Warren Buffett published an article on his analysis of the GEICO stock. He described GEICO, Government Employees Insurance Company, as the “The Security I Like Best.” Warren E. Buffett was then the principal of Omaha, NE, Buffett-Falk & Co. Below is a copy of Warren’s article; a facsimile of the article is also available in the PDF format: Warren_Buffett_-_The_Security_I_Like_Best.pdf.

This article is educational because it clearly shows the considerations that Buffett used to probe the company and evaluate its stock. The way of thinking of how Buffett and Berkshire Hathaway came to own GEICO provides a pattern of how to find and research any investment.

The Security I Like Best: The Government Employees Insurance Co. (GEICO)

Full employment, boom time profits and record dividend payments do not set the stage for depressed security prices. Most industries have been riding this wave of prosperity during the past five years with few ripples to disturb the tide.

The auto insurance business has not shared in the boom. After the staggering losses of the immediate postwar period, the situation began to right itself in 1949. In 1950, stock casualty companies again took it on the chin with underwriting experience the second worst in 15 years. The recent earnings reports of casualty companies, particularly those with the bulk of writings in auto lines, have diverted bull market enthusiasm from their stocks. On the basis of normal earning power and asset factors, many of these stocks appear undervalued.

The nature of the industry is such as to ease cyclical bumps. The majority of purchasers regards auto insurance as a necessity. Contracts must be renewed yearly at rates based upon experience. The lag of rates behind costs, although detrimental in a period of rising prices as has characterized the 1945-1951 period, should prove beneficial if deflationary forces should be set in action.

Other industry advantages include lack of inventory, collection, labor and raw material problems. The hazard of product obsolescence and related equipment obsolescence is also absent.

Government Employees Insurance Corporation was organized in the mid-30’s to provide complete auto insurance on a nationwide basis to an eligible class including: (1) Federal, State and municipal government employees; (2) active and reserve commissioned officers and the first three pay grades of non-commissioned officers of the Armed Forces; (3) veterans who were eligible when on active duty; (4) former policyholders; (5) faculty members of universities, colleges and schools; (6) government contractor employees engaged in defense work exclusively, and (7) stockholders.

The company has no agents or branch offices. As a result, policyholders receive standard auto insurance policies at premium discounts running as high as 30% off manual rates. Claims are handled promptly through approximately 500 representatives throughout the country.

The term “growth company” has been applied with abandon during the past few years to companies whose sales increases represented little more than inflation of prices and general easing of business competition. GEICO qualifies as a legitimate growth company based upon the following record:

Year— Premiums Written Policy Holders 1936 $103,696.31 3,754 1940 768,057.86 25,514 1945 1,638,562.09 51,697 1950 8,016,975.79 143,944 Of course the investor of today does not profit from yesterday’s growth. In GEICO’s case, there is reason to believe the major portion of growth lies ahead. Prior to 1950, the company was only licensed in 15 of 50 jurisdictions including D. C. and Hawaii. At the beginning of the year there were less than 3,000 policyholders in New York State. Yet 25% saved on an insurance bill of $125 in New York should look bigger to the prospect than the 25% saved on the $50 rate in more sparsely settled regions.

As cost competition increases in importance during times of recession, GEICO’s rate attraction should become even more effective in diverting business from the brother-in-law. With insurance rates moving higher due to inflation, the 25% spread in rates becomes wider in terms of dollars and cents.

There is no pressure from agents to accept questionable applicants or renew poor risks. In States where the rate structure is inadequate, new promotion may be halted.

Probably the biggest attraction of GEICO is the profit margin advantage it enjoys. The ratio of underwriting profit to premiums earned in 1949 was 27.5% for GEICO as compared to 3.7% for the 135 stock casualty and surety companies summarized by Best’s. As experience turned for the worse in 1950, Best’s aggregate’s profit margin dropped to 3.0% and GEICO’s dropped to 13.0%. GEICO does not write all casualty lines; however, bodily injury and property damage, both important lines for GEICO, were among the least profitable lines. GEICO also does a large amount of collision writing, which was a profitable line in 1950.

During the first half of 1951, practically all insurers operated in the red on casualty lines with bodily injury and property damage among the most unprofitable. Whereas GEICO’s profit margin was cut to slightly above 9%, Massachusett’s Bonding & Insurance showed a 26% loss, New Amsterdam Casualty an 8% loss, Standard Accident Insurance a 9% loss, etc.

Because of the rapid growth of GEICO, cash dividends have had to remain low. Stock dividends and a 25-for-1 split increased the outstanding shares from 3,000 on June 1, 1948, to 250,000 on Nov. 10, 1951. Valuable rights to subscribe to stock of affiliated companies have also been issued.

Benjamin Graham has been Chairman of the Board since his investment trust acquired and distributed a large block of the stock in 1948. Leo Goodwin, who has guided GEICO’s growth since inception, is the able President. At the end of 1950, the 10 members of the Board of Directors owned approximately one third of the outstanding stock.

Earnings in 1950 amounted to $3.92 as contrasted to $4.71 on the smaller amount of business in 1949. These figures include no allowance for the increase in the unearned premium reserve which was substantial in both years. Earnings in 1953 will be lower than 1950, but the wave of rate increases during the past summer should evidence themselves in 1952 earnings. Investment income quadrupled between 1947 and 1950, reflecting the growth of the company’s assets.

At the present price of about eight times the earnings of 1950, a poor year for the industry, it appears that no price is being paid for the tremendous growth potential of the company.

In 1951, Warren Buffett made his first purchase of GEICO stock. In 1996, Warren Buffett purchased all outstanding stock of GEICO, and folded GEICO into the Berkshire Hathaway umbrella as a subsidiary company. GEICO is part of the most noteworthy of Berkshire Hathaway’s businesses: the insurance business.

Insurance ‘Float’: A Significant Enabler of Berkshire Hathaway’s Success

Berkshire Hathaway’s insurance operations provides Warren Buffett the ‘float’ that has been critical to his success as an investor. This float is money that Berkshire Hathaway holds to pay insurance claims at some point in the future, but in the intervening time can be put to work in stocks and long-term investments that earn returns for Berkshire. In effect, float constitutes borrowed funds at little or no cost. It enables Berkshire Hathaway to purchase businesses and assets beyond what Berkshire Hathaway’s cash and capital would allow. Other than GEICO, Berkshire Hathaway’s major insurance operations include Berkshire Hathaway Reinsurance Group and General Re.

Berkshire Hathaway’s insurance operations provides Warren Buffett the ‘float’ that has been critical to his success as an investor. This float is money that Berkshire Hathaway holds to pay insurance claims at some point in the future, but in the intervening time can be put to work in stocks and long-term investments that earn returns for Berkshire. In effect, float constitutes borrowed funds at little or no cost. It enables Berkshire Hathaway to purchase businesses and assets beyond what Berkshire Hathaway’s cash and capital would allow. Other than GEICO, Berkshire Hathaway’s major insurance operations include Berkshire Hathaway Reinsurance Group and General Re.

GEICO is today the second largest auto insurer in the United States. GEICO’s mascot is a Gold dust day gecko with a Cockney accent. GEICO is well known in popular culture for its advertising, having made a large number of commercials that aim to amuse viewers. The GEICO gecko is voiced by English actor Jake Wood.

Definition: Cook’s Tour

A Cook’s Tour is a guided but cursory tour of the major features of a place or an area.

Broadly, a Cook’s tour is a rapid but extensive glance or survey of a subject matter.

.jpg) According to the Merriam-Webster dictionary, the phrase has its origin in Thomas Cook & Son, the prominent British travel agency, and precursor to the present-day global travel company Thomas Cook Group plc. The first known use of the phrase Cook’s Tour was around circa 1909. Thomas Cook & Son was started in 1872 as a partnership by Thomas Cook and his son, John A Mason Cook.

According to the Merriam-Webster dictionary, the phrase has its origin in Thomas Cook & Son, the prominent British travel agency, and precursor to the present-day global travel company Thomas Cook Group plc. The first known use of the phrase Cook’s Tour was around circa 1909. Thomas Cook & Son was started in 1872 as a partnership by Thomas Cook and his son, John A Mason Cook.

Recommended Reading: Thomas Cook: 150 Years of Popular Tourism by Piers Brendon.

Dave Packard’s 11 Simple Rules

Dave Packard, along with Bill Hewlett, friend and fellow graduate of electrical engineering from Stanford University, started Hewlett-Packard (HP) in Packard’s Palo Alto garage with an initial capital investment of US$538. Bill Hewlett and Dave Packard are known for their legendary people-oriented management style and community consciousness.

Below are eleven simple rules that reflected Dave Packard’s philosophy of work and life. These rules were first presented by Dave Packard at HP’s second annual management conference in 1958 in Sonoma, California. A memo containing these seven simple rules was discovered in Dave’s correspondence file.

.jpg) Think first of the other fellow. This is THE foundation—the first requisite—for getting along with others. And it is the one truly difficult accomplishment you must make. Gaining this, the rest will be “a breeze.”

Think first of the other fellow. This is THE foundation—the first requisite—for getting along with others. And it is the one truly difficult accomplishment you must make. Gaining this, the rest will be “a breeze.”- Build up the other person’s sense of importance. When we make the other person seem less important, we frustrate one of his deepest urges. Allow him to feel equality or superiority, and we can easily get along with him.

- Respect the other man’s personality rights. Respect as something sacred the other fellow’s right to be different from you. No two personalities are ever molded by precisely the same forces.

- Give sincere appreciation. If we think someone has done a thing well, we should never hesitate to let him know it. WARNING: This does not mean promiscuous use of obvious flattery. Flattery with most intelligent people gets exactly the reaction it deserves—contempt for the egotistical “phony” who stoops to it.

- Eliminate the negative. Criticism seldom does what its user intends, for it invariably causes resentment. The tiniest bit of disapproval can sometimes cause a resentment which will rankle—to your disadvantage—for years.

- Avoid openly trying to reform people. Every man knows he is imperfect, but he doesn’t want someone else trying to correct his faults. If you want to improve a person, help him to embrace a higher working goal—a standard, an ideal—and he will do his own “making over” far more effectively than you can do it for him.

.jpg) Try to understand the other person. How would you react to similar circumstances? When you begin to see the “whys” of him you can’t help but get along better with him.

Try to understand the other person. How would you react to similar circumstances? When you begin to see the “whys” of him you can’t help but get along better with him.- Check first impressions. We are especially prone to dislike some people on first sight because of some vague resemblance (of which we are usually unaware) to someone else whom we have had reason to dislike. Follow Abraham Lincoln’s famous self-instruction: “I do not like that man; therefore I shall get to know him better.”

- Take care with the little details. Watch your smile, your tone of voice, how you use your eyes, the way you greet people, the use of nicknames and remembering faces, names and dates. Little things add polish to your skill in dealing with people. Constantly, deliberately think of them until they become a natural part of your personality.

- Develop genuine interest in people. You cannot successfully apply the foregoing suggestions unless you have a sincere desire to like, respect and be helpful to others. Conversely, you cannot build genuine interest in people until you have experienced the pleasure of working with them in an atmosphere characterized by mutual liking and respect.

- Keep it up. That’s all—just keep it up!

For Bill Hewlett and Dave Packard’s legendary management style and the history of Hewlett Packard, read ‘Bill & Dave: How Hewlett and Packard Built the World’s Greatest Company’ by Michael S. Malone and ‘The HP Way: How Bill Hewlett and I Built Our Company’ by David Packard.

Source: HP Retiree Website

What Makes Good People Do Bad Things? The Roots of Unethical Behaviour in Life and Work

The memory of ethics catastrophes at firms large and small like Enron, WorldCom, Tyco, and Hewlett-Packard elevated public bitterness toward corporate executives as never before. Unethical behavior has spoiled the public’s conviction about the inherent goodness in people and spawned charges for more government oversight of private industry.

In free societies, many people identify with Milton Friedman’s laissez faire principle that if society lets its people pursue their personal and professional interests in the context of a capitalistic framework to operate without restraint, positive principled intentions and ethical consequences will naturally ensue. On the contrary, it turns out that most people unaware of the divergence between how ethical people think they are and how ethical they actually are.

Why do people behave unethically? Why do some employees engage in unethical acts such as lying on an expense account, accepting kickbacks, falsifying reports, and forging signatures? One or more of these root cause factors might be at play in unethical behavior:

- Poor ethical leadership

- Poor communications

- Pressure to balance work and family

- Pressure to meet sales or profit goals

- Lack of management support

- Resentment to the workplace and retaliation

- Company policies

- Little or no recognition of achievements

- Long work hours, heavy workload

- Personal financial worries

- Insufficient resources

In the modern societies, with eroding adherence to personal and societal values, the temptation to behave in unethical ways is not going to go away. As young professionals go into business today, the enticement to evade ethics is mounting. We live in a time of deep obligation on individuals and organizations to cut corners, pursue their own personal and professional interests, and forget about the consequences of their behavior on others.

Mungerisms: Charlie Munger’s 100 Best Zingers of All Time

Devotees of Charlie Munger don’t hear a lot from him, particularly in comparison to the frequency of media appearances that his partner at Berkshire Hathaway Warren Buffett makes. But, when Charlie Munger talks, follower’s can be sure they’re always colorful.

Charlie Munger is Warren Buffett’s partner and Vice-Chairman at Berkshire Hathaway, the investment conglomerate. In his capacity, Munger has been a behind-the-scenes co-thinker at Berkshire and has influenced many a decision made by Warren Buffett.

Charlie Munger is Warren Buffett’s partner and Vice-Chairman at Berkshire Hathaway, the investment conglomerate. In his capacity, Munger has been a behind-the-scenes co-thinker at Berkshire and has influenced many a decision made by Warren Buffett.

Munger was chair of Wesco Financial Corporation from 1984 through 2011. He is also the chair of the Daily Journal Corporation, based in Los Angeles, California, and a director of Costco Wholesale Corporation. Unlike Warren Buffett, Charlie Munger has claimed that he is a generalist for whom investment is only one of a broad range of interests that include architecture, philosophy, philanthropy, investing, yacht-design, etc.

Charlie Munger’s quotations and pithy comments have come to be known as ‘Mungerisms.’ Many Mungerisms are witty one-liners and maxims that reflect Charlie Munger’s humbleness and advocacy of elemental wisdom.

- “I don’t spend much time regretting the past, once I’ve taken my lesson from it. I don’t dwell on it.”

- “Opportunity cost is a huge filter in life. If you’ve got two suitors who are really eager to have you and one is way the hell better than the other, you do not have to spend much time with the other. And that’s the way we filter out buying opportunities.”

- “In my whole life, nobody has ever accused me of being humble. Although humility is a trait I much admire, I don’t think I quite got my full share.”

.jpg) ” The investment game always involves considering both quality and price, and the trick is to get more quality than you pay for in price. It’s just that simple.”

” The investment game always involves considering both quality and price, and the trick is to get more quality than you pay for in price. It’s just that simple.”- “Determine value apart from price; progress apart from activity; wealth apart from size.”

- “Someone will always be getting richer faster than you. This is not a tragedy.”

- “We’re the tortoise that has outrun the hare because it chose the easy predictions.”

- “Remember that reputation and integrity are your most valuable assets – and can be lost in a heartbeat.”

- “Our ideas are so simple that people keep asking us for mysteries when all we have are the most elementary ideas.”

- “For society, the Internet is wonderful, but for capitalists, it will be a net negative. It will increase efficiency, but lots of things increase efficiency without increasing profits. It is way more likely to make American businesses less profitable than more profitable. This is perfectly obvious, but very little understood.”

- “People always underestimate the ability of earth to increase its carrying capacity.”

- “I’m not entitled to have an opinion unless I can state the arguments against my position better than the people who are in opposition. I think that I am qualified to speak only when I’ve reached that state.”

- “Over the very long term, history shows that the chances of any business surviving in a manner agreeable to a company’s owners are slim at best.”

- “We try more to profit from always remembering the obvious than from grasping the esoteric.”

- “We have a history when things are really horrible of wading in when no one else will.”

- “In the corporate world, if you have analysts, due diligence, and no horse sense, you’ve just described hell.”

- “Forgetting your mistakes is a terrible error if you are trying to improve your cognition.”

- “Whenever you think something or some person is ruining your life, it’s you. A victimization mentality is so debilitating.”

- “Virtually every investment expert’s public assessment is that he is above average, no matter what is the evidence to the contrary.”

- “People have always had this craving to have someone tell them the future. Long ago, kings would hire people to read sheep guts. There’s always been a market for people who pretend to know the future. Listening to today’s forecasters is just as crazy as when the king hired the guy to look at the sheep guts.”

- “Intelligent people make decisions based on opportunity costs.”

.jpg) ” Today, it seems to be regarded as the duty of CEOs to make the stock go up. This leads to all sorts of foolish behavior. We want to tell it like it is.”

” Today, it seems to be regarded as the duty of CEOs to make the stock go up. This leads to all sorts of foolish behavior. We want to tell it like it is.”- “Fixable but unfixed bad performance is bad character and tends to create more of itself, causing more damage to the excuse giver with each tolerated instance.”

- “We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side. If you can’t state arguments against what you believe better than your detractors, you don’t know enough.”

- “Above all, never fool yourself, and remember that you are the easiest person to fool.”

- “In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time – none, zero.”

- “The best armor of old age is a well-spent life preceding it.”

- “There are always people who will be better at something than you are. You have to learn to be a follower before you become a leader.”

- “The number one idea is to view a stock as an ownership of the business and to judge the staying quality of the business in terms of its competitive advantage. Look for more value in terms of discounted future cash-flow than you are paying for. Move only when you have an advantage.”

- “If you buy something because it’s undervalued, then you have to think about selling it when it approaches your calculation of its intrinsic value. That’s hard. But if you buy a few great companies, then you can sit on your ass. That’s a good thing.”

- “We get these questions a lot from the enterprising young. It’s a very intelligent question: You look at some old guy who’s rich and you ask, ‘How can I become like you, except faster?”

- “The more hard lessons you can learn vicariously rather than through your own hard experience, the better.”

- “Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

- “A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.”

- “Almost all good businesses engage in ‘pain today, gain tomorrow’ activities.”

- “Three rules for a career: 1) Don’t sell anything you wouldn’t buy yourself; 2) Don’t work for anyone you don’t respect and admire; and 3) Work only with people you enjoy.”

- “There is nothing more counterproductive than envy. Someone in the world will always be better than you. Of all the sins, envy is easily the worst, because you can’t even have any fun with it. It’s a total net loss.”

- “A lot of success in life and business comes from knowing what you want to avoid: early death, a bad marriage, etc.”

- “Acquire worldly wisdom and adjust your behavior accordingly. If your new behavior gives you a little temporary unpopularity with your peer group then to hell with them.”

- “The ethos of not fooling yourself is one of the best you could possibly have. It’s powerful because it’s so rare.”

- “If you always tell people why, they’ll understand it better, they’ll consider it more important, and they’ll be more likely to comply.”

- “Acknowledging what you don’t know is the dawning of wisdom.”

- “Checklist routines avoid a lot of errors. You should have all of this elementary wisdom, and you should go through a mental checklist in order to use it. There is no other procedure that will work as well.”

- “Understanding how to be a good investor makes you a better business manager and vice versa.”

- “Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Step by step you get ahead, but not necessarily in fast spurts. But you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day. At the end of the day – if you live long enough – most people get what they deserve.”

- “I agree with Peter Drucker that the culture and legal systems of the United States are especially favorable to shareholder interests, compared to other interests and compared to most other countries. Indeed, there are many other countries where any good going to public shareholders has a very low priority and almost every other constituency stands higher in line.”

- “Everywhere there is a large commission, there is a high probability of a rip-off.”

- “Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.”

- “You must know the big ideas in the big disciplines, and use them routinely — all of them, not just a few. Most people are trained in one model — economics, for example — and try to solve all problems in one way. You know the old saying: to the man with a hammer, the world looks like a nail. This is a dumb way of handling problems.”

- “There are worse situations than drowning in cash and sitting, sitting, sitting. I remember when I wasn’t awash in cash — and I don’t want to go back.”

- “No CEO examining books today understands what the hell is going on.”

- “Never, ever, think about something else when you should be thinking about the power of incentives.”

- “There are some things you should pay up for, like quality businesses and people.”

- “Avoid working directly under somebody you don’t admire and don’t want to be like.”

- “The best thing a human being can do is to help another human being know more.”

- “People calculate too much and think too little.”

- “You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced. That’s value investing.”

- “It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it – who look and sift the world for a mispriced bet – that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time they don’t. It’s just that simple.”

- “Everybody engaged in complex work needs colleagues. Just the discipline of having to put your thoughts in order with somebody else is a very useful thing.””

- “We don’t care about quarterly earnings (though obviously we care about how the business is doing over time) and are unwilling to manipulate in any way to make some quarter look better.”

- “One of the great defenses if you’re worried about inflation is not to have a lot of silly needs in your life — if you don’t need a lot of material goods.”

- “There are a lot of things we pass on. We have three baskets: in, out, and too tough…We have to have a special insight, or we’ll put it in the ‘too tough’ basket. All of you have to look for a special area of competency and focus on that.”

- “You can progress only when you learn the method of learning.”

- “We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.”

- “Experience tends to confirm a long-held notion that being prepared, on a few occasions in a lifetime, to act promptly in scale, in doing some simple and logical thing, will often dramatically improve the financial results of that lifetime. A few major opportunities, clearly recognizable as such, will usually come to one who continuously searches and waits, with a curious mind that loves diagnosis involving multiple variables. And then all that is required is a willingness to bet heavily when the odds are extremely favorable, using resources available as a result of prudence and patience in the past.”

.jpg) ” I know someone who lives next door to what you would actually call a fairly modest house that just sold for $17 million. There are some very extreme housing price bubbles going on.”

” I know someone who lives next door to what you would actually call a fairly modest house that just sold for $17 million. There are some very extreme housing price bubbles going on.”- “You must have the confidence to override people with more credentials than you whose cognition is impaired by incentive-caused bias or some similar psychological force that is obviously present. But there are also cases where you have to recognize that you have no wisdom to add — and that your best course is to trust some expert.”

- “If you get a lot of heavy ideology young — and then you start expressing it — you are really locking your brain into a very unfortunate pattern.”

- “We just throw some decisions into the ‘too hard’ file and go onto the others.”

- “Intense interest in any subject is indispensable if you’re really going to excel in it.”

- “Understanding both the power of compound return and the difficulty of getting it is the heart and soul of understanding a lot of things.””

- “Recognize reality even when you don’t like it – especially when you don’t like it.”

- “I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart…”

- “All intelligent investing is value investing – acquiring more than you are paying for. You must value the business in order to value the stock.”

- “In my life there are not that many questions I can’t properly deal with using my $40 adding machine and dog-eared compound interest table.”

- “Don’t confuse correlation and causation. Almost all great records eventually dwindle.”

- “Most people are too fretful, they worry too much. Success means being very patient, but aggressive when it’s time.”

- “The safest way to try to get what you want is to try to deserve what you want. It’s such a simple idea. It’s the golden rule. You want to deliver to the world what you would buy if you were on the other end.”

- “Assume life will be really tough, and then ask if you can handle it. If the answer is yes, you’ve won.”

- “I find it quite useful to think of a free-market economy – or partly free market economy – as sort of the equivalent of an ecosystem. Just as animals flourish in niches, people who specialize in some narrow niche can do very well.”

- “I would rather throw a viper down my shirt than hire a compensation consultant.”

- “Thinking that what’s good for you is good for the wider civilization, and rationalizing foolish or evil conduct, based on your subconscious tendency to serve yourself, is a terrible way to think.”

- “There has never been a master plan. Anyone who wanted to do it, we fired because it takes on a life of its own and doesn’t cover new reality. We want people taking into account new information.”

- “You need a different checklist and mental models for different companies. I can never make it easy by saying, ‘Here are three things.’ You have to derive it yourself to ingrain it in your head for the rest of your life.”

- “Just as a man working with his tools should know its limitations, a man working with his cognitive apparatus must know its limitations.”

- “If you don’t allow for self-serving bias in the conduct of others, you are, again, a fool.”

- “It’s a good habit to trumpet your failures and be quiet about your successes.”

- “Those who will not face improvements because they are changes, will face changes that are not improvements.”

- “Smart people aren’t exempt from professional disasters from overconfidence. Often, they just run aground in the more difficult voyages they choose, relying on their self-appraisals that they have superior talents and methods.”

- “I’m right, and you’re smart, and sooner or later you’ll see I’m right.”

- “Mimicking the herd invites regression to the mean.”

- “I think track records are very important. If you start early trying to have a perfect one in some simple thing like honesty, you’re well on your way to success in this world.”

.jpg) ” A lot of opportunities in life tend to last a short while, due to some temporary inefficiency… For each of us, really good investment opportunities aren’t going to come along too often and won’t last too long, so you’ve got to be ready to act and have a prepared mind.”

” A lot of opportunities in life tend to last a short while, due to some temporary inefficiency… For each of us, really good investment opportunities aren’t going to come along too often and won’t last too long, so you’ve got to be ready to act and have a prepared mind.”- “Warren spends 70 hours a week thinking about investing.”

- “If all you succeed in doing in life is getting rich by buying little pieces of paper, it’s a failed life. Life is more than being shrewd in wealth accumulation.”

- “Well, some of our success we predicted and some of it was fortuitous.”

- “What’s the best way to get a good spouse? The best single way is to deserve a good spouse because a good spouse is by definition not nuts.”

- “Spend less than you make; always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. This is such a no-brainer.”

- “You want to be very careful with intense ideology. It presents a big danger for the only mind you’re ever going to get.”

- “I try to get rid of people who always confidently answer questions about which they don’t have any real knowledge.”

Insightful books about Charlie Munger include Poor Charlie’s Almanack, Seeking Wisdom: From Darwin to Munger, and Damn Right: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger.

More Mungerisms—Yet More Zingers from the Inimitable Charlie Munger

- “We get these questions a lot from the enterprising young. It’s a very intelligent question: You look at some old guy who’s rich and you ask, ‘How can I become like you, except faster?”

- “It’s natural that you’d have more brains going into money management. There are so many huge incomes in money management and investment banking—it’s like ants to sugar. There are huge incentives for a man to take up money management as opposed to, say, physics, and it’s a lot easier.”

- “Black-Scholes works for short-term options, but if it’s a long-term option and you think you know something [about the underlying asset], it’s insane to use Black-Scholes.”

- “The interesting thing about it to me is the mindset. With all these “helpers” running around, they talk about doing deals. We talk about welcoming partners. The guy doing deals, he wants to do a deal and then unwind it in the near future. It’s totally opposite for us. We like to build lasting relationships. I think our system will work better in the long term than flipping deals. I think there are so many of them [helpers] that they’ll get in each other’s way. I don’t think they’ll make enough money to meet their expectations, by flipping, flipping, flipping.”

- “Warren and I have not made our way in life by making successful macroeconomic predictions and betting on our conclusions.”

- “A lot of success in life and business comes from knowing what you want to avoid: early death, a bad marriage, etc.”

- “Well, the questioner came from Singapore which has perhaps the best economic record in the history of any developing economy and therefore he referred to 15% per annum as modest. It’s not modest—it’s arrogant. Only someone from Singapore would call it modest.”

- “People always underestimate the ability of earth to increase its carrying capacity.”

- “Civilized people don’t buy gold. They invest in productive businesses.”

- “Just as a man working with his tools should know its limitations, a man working with his cognitive apparatus must know its limitations.”

- “We haven’t pushed it as hard as other people would have pushed it. I don’t want to go back to Go. I’ve been to Go. A lot of our shareholders have a majority of their net worth in Berkshire, and they don’t want to go back to Go either.”

- “There are always people who will be better at some thing than you are. You have to learn to be a follower before you become a leader.”

- “The more hard lessons you can learn vicariously rather than through your own hard experience, the better.”

- “Warren spends 70 hours a week thinking about investing.”

- “Size will hurt returns. Look at Berkshire Hathaway—the last five things Warren has done have generated returns that are splendid by historical standards, but now give him $100 billion in assets and measure outcomes across all of it, it doesn’t look so good. We can only buy big positions, and the only time we can get big positions is during a horrible period of decline or stasis. That really doesn’t happen very often.”

- “Obviously, consideration of costs is key, including opportunity costs. Of course capital isn’t free. It’s easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital. They say that if you’re generating a 100% return on capital, then you shouldn’t invest in something that generates an 80% return on capital. It’s crazy.”

- “As for what we like least, we don’t want kleptocracies. We need a rule of law. If people are stealing from the companies, we don’t need that.”

- “I think it would be a great improvement if there were no D&O insurance. The counter-argument is that no-one with any money would serve on a board. But I think net net you’d be better off.”

- “Generally speaking, it can’t be good to be running a big current account deficit and a big fiscal deficit and have them both growing. You would be thinking the end there would be a comeuppance. … [But] it isn’t as though all the other options look wonderful compared to the US. It gives me some feeling that what I regard as fiscal misbehavior on our part could go on some time without paying the price.”

- “I’ve never succeeded in something I wasn’t interested in.”

- “Deferred gratification really works if you want to get better and better.”

- “We’re partial to putting out large amounts of money where we won’t have to make another decision.”

- “In effect about half our spare cash was stashed in currencies other than the dollar. I consider that a non-event. As it happens it’s been a very profitable non-event.”

- “The general assumption is that it must be easy to sit behind a desk and people will bring in one good opportunity after another—this was the attitude in venture capital until a few years ago. This was not the case at all for us—we scrounged around for companies to buy. For 20 years, we didn’t buy more than one or two per year. …It’s fair to say that we were rooting around. There were no commissioned salesmen. Anytime you sit there waiting for a deal to come by, you’re in a very dangerous seat.”

- “I agree with Peter Drucker that the culture and legal systems of the United States are especially favorable to shareholder interests, compared to other interests and compared to most other countries. Indeed, there are many other countries where any good going to public shareholders has a very low priority and almost every other constituency stands higher in line.”

- “If you buy something because it’s undervalued, then you have to think about selling it when it approaches your calculation of its intrinsic value. That’s hard. But if you buy a few great companies, then you can sit on your ass. That’s a good thing.”

- “Even if you specialize, you should still spend 10-20% of your time learning the big ideas of the major disciplines.”

- “In the 1930s, there as a stretch here you could borrow more against the real estate than you could sell it for. I think that’s hat’s going on in today’s private-equity world”

- “If you always tell people why, they’ll understand it better, they’ll consider it more important, and they’ll be more likely to comply.”

- “I like the Buffett system (0% fee, 6% hurdle, 25% gain-share). I’m looking at Mohnish Pabrai who still uses it. I wish it would spread.”

- “Acknowledging what you don’t know is the dawning of wisdom.”

- “Beta and modern portfolio theory and the like—none of it makes any sense to me.”

- “Opportunity cost is a huge filter in life. If you’ve got two suitors who are really eager to have you and one is way the hell better than the other, you do not have to spend much time with the other. And that’s the way we filter out buying opportunities.”

- “I have concluded that most PhD economists under appraise the power of the common-stock-based “wealth effect,” under current extreme conditions. … “Wealth effects” involve mathematical puzzles that are not nearly so well worked out as physics theories and never can be. …what has happened in Japan … has shaken up academic economics, as it obviously should, creating strong worries about recession from “wealth effects” in reverse.”

- “A lot of share-buying, not bargain-seeking, is designed to prop stock prices up. Thirty to 40 years ago, it was very profitable to look at companies that were aggressively buying their own shares. They were motivated simply to buy below what it was worth.”

- “There are a lot of things we pass on. We have three baskets: in, out, and too tough…We have to have a special insight, or we’ll put it in the ‘too tough’ basket. All of you have to look for a special area of competency and focus on that.”

- “I try to get rid of people who always confidently answer questions about which they don’t have any real knowledge.”

- “In terms of which businesses succeed and which businesses fail, advantages of scale are ungodly important. … In some businesses, the very nature of things is to sort of cascade toward the overwhelming dominance of one firm. And these advantages of scale are so great, for example, that when Jack Welch came into General Electric, he just said, “To hell with it. We’re either going to be #1 or #2 in every field we’re in or we’re going to be out.”

- “Whenever you think something or some person is ruining your life, it’s you. A victimization mentality is so debilitating.”

- “Our investment style has been given a name—focus investing—which implies ten holdings, not one hundred or four hundred. The idea that it is hard to find good investments, so concentrate in a few, seems to me to be an obvious idea. But 98% of the investment world does not think this way. It’s been good for us.”

- “We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.”

- “There are a lot of things in life way more important than money. All that said, some people do get confused. I play golf with a man who says, ” What good is health? You can’t buy money with it.”

- “Am I comfortable with a non-diversified portfolio? Yes. The Mungers have three stocks: Berkshire, Costco, and Li Lu’s fund.”

- “I don’t think operating over many disciplines is a good idea for most people…get good at something that society rewards.”

- “Mimicking the herd invites regression to the mean.”

- “We just throw some decisions into the ‘too hard’ file and go onto the others.”

- “In business we often find that the winning system goes almost ridiculously far in maximizing and or minimizing one or a few variables—like the discount warehouses of Costco.”

- “You only need one cinch. When you get the chance, step up to the pie cart with a big pan.”

- “I know someone who lives next door to what you would actually call a fairly modest house that just sold for $17 million. There are some very extreme housing price bubbles going on.”

- “We have a history when things are really horrible of wading in when no one else will.”

- “We don’t care about quarterly earnings (though obviously we care about how the business is doing over time) and are unwilling to manipulate in any way to make some quarter look better.”

- “Everywhere there is a large commission, there is a high probability of a rip-off.”

- “Wrigley is a great business, but that doesn’t solve the problem. Buying great businesses at advantageous prices is very tough.”

- “I live surrounded by Koreans in L.A. I would regard Korean culture and what they’ve created as one of the most remarkable in the history of capitalism. We don’t think it’s an accident that Iscar discovered Korea. If you try to find 10 countries better than Korea … you won’t get through one hand. We are huge admirers of Korea.”

- “Diversification is great for people who know nothing…one (investment) will work if you do it right.”

- “Anyone with an engineering frame of mind will look at [accounting standards] and want to throw up.”

- “In many areas of life the only way to win is to grind away and work hard for a very long time.”

- “I think democracies are prone to inflation because politicians will naturally spend [excessively]—they have the power to print money and will use money to get votes. If you look at inflation under the Roman Empire, with absolute rulers, they had much greater inflation, so we don’t set the record. It happens over the long-term under any form of government.”

- “There are worse situations than drowning in cash and sitting, sitting, sitting. I remember when I wasn’t awash in cash—and I don’t want to go back.”

- “Our biggest mistakes, were things we didn’t do, companies we didn’t buy.”

- “Smart people aren’t exempt from professional disasters from overconfidence. Often, they just run aground in the more difficult voyages they choose, relying on their self-appraisals that they have superior talents and methods.”

- “You must know the big ideas in the big disciplines, and use them routinely—all of them, not just a few. Most people are trained in one model—economics, for example—and try to solve all problems in one way. You know the old saying: to the man with a hammer, the world looks like a nail. This is a dumb way of handling problems.”

- “Mutual funds charge 2% per year and then brokers switch people between funds, costing another 3-4 percentage points. The poor guy in the general public is getting a terrible product from the professionals. I think it’s disgusting. It’s much better to be part of a system that delivers value to the people who buy the product. But if it makes money, we tend to do it in this country.”

- “You want to be very careful with intense ideology. It presents a big danger for the only mind you’re ever going to get.”

- “I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart…”

- “We’ve had the most massive creation of wealth for people a lot younger than those who formerly got wealth in the history of the world. The world is full of young people who really want to get rich, and “when I left school] nobody thought it was a reasonable possibility.”

- “Generally speaking, if you’re counting on outside directors to act [forcefully to protect your interests as a shareholder, then you’re crazy]. As a general rule in America, boards act only if there’s been a severe disgrace. My friend Joe was asked to be on the board of Northwestern Bell and he jokes that ‘it was the last thing they ever asked me.’ I think you get better directors when you get directors who don’t need the money. When it’s half your income and all your retirement, you’re not likely to be very independent. But when you have money and an existing reputation that you don’t want to lose, then you’ll act more independently.”

- “Warren talked to guy at an investment bank and asked how they made their money. He said, “Off the top, off the bottom, off both sides and in the middle.”

- “I see almost no change in the price of the composite product that flows through Costco I don’t feel sorry for the people who pay $27 million for an 8,000-square-foot condo in Manhattan. So inflation comes in places.”

- “There are some things you should pay up for, like quality businesses and people.”

- “I always like it when someone attractive to me agrees with me, so I have fond memories of Phil Fisher. The idea that it was hard to find good investments, so concentrate in a few, seems to me to be an obviously good idea. But 98% of the investment world doesn’t think this way.”

- “I constantly see people rise in life who are not the smartest—sometimes not even the most diligent. But they are learning machines; they go to bed every night a little wiser than when they got up. And, boy, does that habit help, particularly when you have a long run ahead of you.”

- “If you took our top fifteen decisions out, we’d have a pretty average record. It wasn’t hyperactivity, but a hell of a lot of patience. You stuck to your principles and when opportunities came along, you pounce on them with vigor.”

- “I don’t think there’s any business that we’ve bought that would have sold itself to a hedge fund. There’s a class of businesses that doesn’t want to deal with private-equity and hedge funds…thank God”

- “Being short and seeing a promoter take the stock up is very irritating. It’s not worth it to have that much irritation in your life.”

- “Understanding how to be a good investor makes you a better business manager and vice versa.”

- “Black-Scholes is a know-nothing system. If you know nothing about value—only price—then Black-Scholes is a pretty good guess at what a 90-day option might be worth. But the minute you get into longer periods of time, it’s crazy to get into Black-Scholes.”

- “We try more to profit from always remembering the obvious than from grasping the esoteric.”

- “The idea of a margin of safety, a Graham precept, will never be obsolete. The idea of making the market your servant will never be obsolete. The idea of being objective and dispassionate will never be obsolete. So Graham had a lot of wonderful ideas.”

- “Our ideas are so simple that people keep asking us for mysteries when all we have are the most elementary ideas.”

- “Closet indexing….you’re paying a manager a fortune and he has 85% of his assets invested parallel to the indexes. If you have such a system, you’re being played for a sucker.”

- “Don’t confuse correlation and causation. Almost all great records eventually dwindle.”

- “It’s hard to predict what will happen with two brands in a market. Sometimes they will behave in a gentlemanly way, and sometimes they’ll pound each other. I know of no way to predict whether they’ll compete moderately or to the death. If you could figure it out, you could make a lot of money.”

- “Suppose, any one of you knew of a wonderful thing right now that you were overwhelmingly confident- and correctly so- would produce about 12% per annum compounded as far as you could see. Now, if you actually had that available, and by going into it you were forfeiting all opportunities to make money faster- there’re a lot of you who wouldn’t like that. But a lot of you would think, “What the hell do I care if somebody else makes money faster?” There’s always going to be somebody who is making money faster, running the mile faster or what have you. So in a human sense, once you get something that works fine in your life, the idea of caring terribly that somebody else is making money faster strikes me as insane.”

- “It’s a good habit to trumpet your failures and be quiet about your successes.”

- “There are actually businesses, that you will find a few times in a lifetime, where any manager could raise the return enormously just by raising prices—and yet they haven’t done it. So they have huge untapped pricing power that they’re not using. That is the ultimate no-brainer. … Disney found that it could raise those prices a lot and the attendance stayed right up. So a lot of the great record of Eisner and Wells … came from just raising prices at Disneyland and Disneyworld and through video cassette sales of classic animated movies… At Berkshire Hathaway, Warren and I raised the prices of See’s Candy a little faster than others might have. And, of course, we invested in Coca-Cola—which had some untapped pricing power. And it also had brilliant management. So a Goizueta and Keough could do much more than raise prices. It was perfect.”

- “What we don’t like in modern capitalism is the expectations game. It’s not the kissing cousin of evil; it’s the blood brother.”

- “If the technology hadn’t changed, [newspapers would] still be great businesses. Network TV [in its heyday,] anyone could run and do well.”