.jpg)

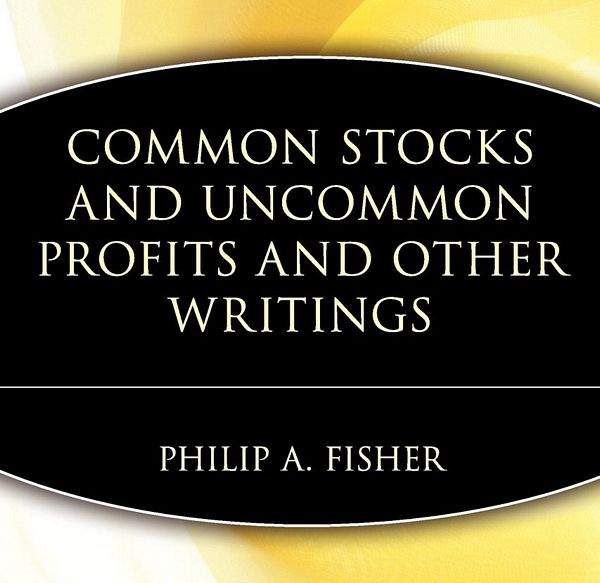

In his 2013 annual letter to Berkshire Hathaway Shareholders, Warren Buffet extols his mentor Ben Graham’s discourse on value investing, “The Intelligent Investor.” Warren has previously described The Intelligent Investor as “by far the best book on investing ever written.”

I learned most of the thoughts in this investment discussion from Ben’s book The Intelligent Investor, which I bought in 1949. My financial life changed with that purchase.

And:

.jpg) A couple of interesting sidelights about the book: Later editions included a postscript describing an unnamed investment that was a bonanza for Ben. Ben made the purchase in 1948 when he was writing the first edition and—brace yourself—the mystery company was GEICO. If Ben had not recognized the special qualities of GEICO when it was still in its infancy, my future and Berkshire’s would have been far different.

A couple of interesting sidelights about the book: Later editions included a postscript describing an unnamed investment that was a bonanza for Ben. Ben made the purchase in 1948 when he was writing the first edition and—brace yourself—the mystery company was GEICO. If Ben had not recognized the special qualities of GEICO when it was still in its infancy, my future and Berkshire’s would have been far different.

And,

When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the company enjoyed compared to the expenses borne by the giants of the industry. That operational efficiency continues today and is an all-important asset. No one likes to buy auto insurance. But almost everyone likes to drive. The insurance needed is a major expenditure for most families. Savings matter to them—and only a low-cost operation can deliver these.

Warren Buffett’s 1951 Analysis Article: “The Security I Like Best”: GEICO

In the 06-Dec-1961 (Thursday) edition of The Commercial and Financial Chronicle, a weekly business newspaper in the United States, Warren Buffett published an article on his analysis of the GEICO stock. He described GEICO, Government Employees Insurance Company, as the “The Security I Like Best.” Warren E. Buffett was then the principal of Omaha, NE, Buffett-Falk & Co. Below is a copy of Warren’s article; a facsimile of the article is also available in the PDF format: Warren_Buffett_-_The_Security_I_Like_Best.pdf.

In the 06-Dec-1961 (Thursday) edition of The Commercial and Financial Chronicle, a weekly business newspaper in the United States, Warren Buffett published an article on his analysis of the GEICO stock. He described GEICO, Government Employees Insurance Company, as the “The Security I Like Best.” Warren E. Buffett was then the principal of Omaha, NE, Buffett-Falk & Co. Below is a copy of Warren’s article; a facsimile of the article is also available in the PDF format: Warren_Buffett_-_The_Security_I_Like_Best.pdf.

This article is educational because it clearly shows the considerations that Buffett used to probe the company and evaluate its stock. The way of thinking of how Buffett and Berkshire Hathaway came to own GEICO provides a pattern of how to find and research any investment.

The Security I Like Best: The Government Employees Insurance Co. (GEICO)

Full employment, boom time profits and record dividend payments do not set the stage for depressed security prices. Most industries have been riding this wave of prosperity during the past five years with few ripples to disturb the tide.

The auto insurance business has not shared in the boom. After the staggering losses of the immediate postwar period, the situation began to right itself in 1949. In 1950, stock casualty companies again took it on the chin with underwriting experience the second worst in 15 years. The recent earnings reports of casualty companies, particularly those with the bulk of writings in auto lines, have diverted bull market enthusiasm from their stocks. On the basis of normal earning power and asset factors, many of these stocks appear undervalued.

The nature of the industry is such as to ease cyclical bumps. The majority of purchasers regards auto insurance as a necessity. Contracts must be renewed yearly at rates based upon experience. The lag of rates behind costs, although detrimental in a period of rising prices as has characterized the 1945-1951 period, should prove beneficial if deflationary forces should be set in action.

Other industry advantages include lack of inventory, collection, labor and raw material problems. The hazard of product obsolescence and related equipment obsolescence is also absent.

Government Employees Insurance Corporation was organized in the mid-30’s to provide complete auto insurance on a nationwide basis to an eligible class including: (1) Federal, State and municipal government employees; (2) active and reserve commissioned officers and the first three pay grades of non-commissioned officers of the Armed Forces; (3) veterans who were eligible when on active duty; (4) former policyholders; (5) faculty members of universities, colleges and schools; (6) government contractor employees engaged in defense work exclusively, and (7) stockholders.

The company has no agents or branch offices. As a result, policyholders receive standard auto insurance policies at premium discounts running as high as 30% off manual rates. Claims are handled promptly through approximately 500 representatives throughout the country.

The term “growth company” has been applied with abandon during the past few years to companies whose sales increases represented little more than inflation of prices and general easing of business competition. GEICO qualifies as a legitimate growth company based upon the following record:

| Year— |

Premiums Written |

Policy Holders |

| 1936 |

$103,696.31 |

3,754 |

| 1940 |

768,057.86 |

25,514 |

| 1945 |

1,638,562.09 |

51,697 |

| 1950 |

8,016,975.79 |

143,944 |

Of course the investor of today does not profit from yesterday’s growth. In GEICO’s case, there is reason to believe the major portion of growth lies ahead. Prior to 1950, the company was only licensed in 15 of 50 jurisdictions including D. C. and Hawaii. At the beginning of the year there were less than 3,000 policyholders in New York State. Yet 25% saved on an insurance bill of $125 in New York should look bigger to the prospect than the 25% saved on the $50 rate in more sparsely settled regions.

As cost competition increases in importance during times of recession, GEICO’s rate attraction should become even more effective in diverting business from the brother-in-law. With insurance rates moving higher due to inflation, the 25% spread in rates becomes wider in terms of dollars and cents.

There is no pressure from agents to accept questionable applicants or renew poor risks. In States where the rate structure is inadequate, new promotion may be halted.

Probably the biggest attraction of GEICO is the profit margin advantage it enjoys. The ratio of underwriting profit to premiums earned in 1949 was 27.5% for GEICO as compared to 3.7% for the 135 stock casualty and surety companies summarized by Best’s. As experience turned for the worse in 1950, Best’s aggregate’s profit margin dropped to 3.0% and GEICO’s dropped to 13.0%. GEICO does not write all casualty lines; however, bodily injury and property damage, both important lines for GEICO, were among the least profitable lines. GEICO also does a large amount of collision writing, which was a profitable line in 1950.

During the first half of 1951, practically all insurers operated in the red on casualty lines with bodily injury and property damage among the most unprofitable. Whereas GEICO’s profit margin was cut to slightly above 9%, Massachusett’s Bonding & Insurance showed a 26% loss, New Amsterdam Casualty an 8% loss, Standard Accident Insurance a 9% loss, etc.

Because of the rapid growth of GEICO, cash dividends have had to remain low. Stock dividends and a 25-for-1 split increased the outstanding shares from 3,000 on June 1, 1948, to 250,000 on Nov. 10, 1951. Valuable rights to subscribe to stock of affiliated companies have also been issued.

Benjamin Graham has been Chairman of the Board since his investment trust acquired and distributed a large block of the stock in 1948. Leo Goodwin, who has guided GEICO’s growth since inception, is the able President. At the end of 1950, the 10 members of the Board of Directors owned approximately one third of the outstanding stock.

Earnings in 1950 amounted to $3.92 as contrasted to $4.71 on the smaller amount of business in 1949. These figures include no allowance for the increase in the unearned premium reserve which was substantial in both years. Earnings in 1953 will be lower than 1950, but the wave of rate increases during the past summer should evidence themselves in 1952 earnings. Investment income quadrupled between 1947 and 1950, reflecting the growth of the company’s assets.

At the present price of about eight times the earnings of 1950, a poor year for the industry, it appears that no price is being paid for the tremendous growth potential of the company.

In 1951, Warren Buffett made his first purchase of GEICO stock. In 1996, Warren Buffett purchased all outstanding stock of GEICO, and folded GEICO into the Berkshire Hathaway umbrella as a subsidiary company. GEICO is part of the most noteworthy of Berkshire Hathaway’s businesses: the insurance business.

Insurance ‘Float’: A Significant Enabler of Berkshire Hathaway’s Success

Berkshire Hathaway’s insurance operations provides Warren Buffett the ‘float’ that has been critical to his success as an investor. This float is money that Berkshire Hathaway holds to pay insurance claims at some point in the future, but in the intervening time can be put to work in stocks and long-term investments that earn returns for Berkshire. In effect, float constitutes borrowed funds at little or no cost. It enables Berkshire Hathaway to purchase businesses and assets beyond what Berkshire Hathaway’s cash and capital would allow. Other than GEICO, Berkshire Hathaway’s major insurance operations include Berkshire Hathaway Reinsurance Group and General Re.

Berkshire Hathaway’s insurance operations provides Warren Buffett the ‘float’ that has been critical to his success as an investor. This float is money that Berkshire Hathaway holds to pay insurance claims at some point in the future, but in the intervening time can be put to work in stocks and long-term investments that earn returns for Berkshire. In effect, float constitutes borrowed funds at little or no cost. It enables Berkshire Hathaway to purchase businesses and assets beyond what Berkshire Hathaway’s cash and capital would allow. Other than GEICO, Berkshire Hathaway’s major insurance operations include Berkshire Hathaway Reinsurance Group and General Re.

GEICO is today the second largest auto insurer in the United States. GEICO’s mascot is a Gold dust day gecko with a Cockney accent. GEICO is well known in popular culture for its advertising, having made a large number of commercials that aim to amuse viewers. The GEICO gecko is voiced by English actor Jake Wood.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

6:00 PM to 9:00 PM:

6:00 PM to 9:00 PM:

7:30 AM to 4:15 PM: Shop for products from

7:30 AM to 4:15 PM: Shop for products from

Meeting credentials are required to enter the CenturyLink Center for the Berkshire Hathaway meeting or the adjoining area to hit the stores of the many Berkshire subsidiaries. Meeting credentials are also required to get special shareholder pricing at Borsheims, Nebraska Furniture Mart, and other stores that might offer shareholder discounts.

Meeting credentials are required to enter the CenturyLink Center for the Berkshire Hathaway meeting or the adjoining area to hit the stores of the many Berkshire subsidiaries. Meeting credentials are also required to get special shareholder pricing at Borsheims, Nebraska Furniture Mart, and other stores that might offer shareholder discounts..jpg)

.jpg)

In the 06-Dec-1961 (Thursday) edition of

In the 06-Dec-1961 (Thursday) edition of  Berkshire Hathaway’s

Berkshire Hathaway’s

.jpg)

.jpg)

.jpg)

.jpg)

If you think

If you think .jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)