A multidisciplinary approach involves drawing appropriately from multiple disciplines to redefine problems outside of normal boundaries and reach solutions based on a new understanding of complex situations.

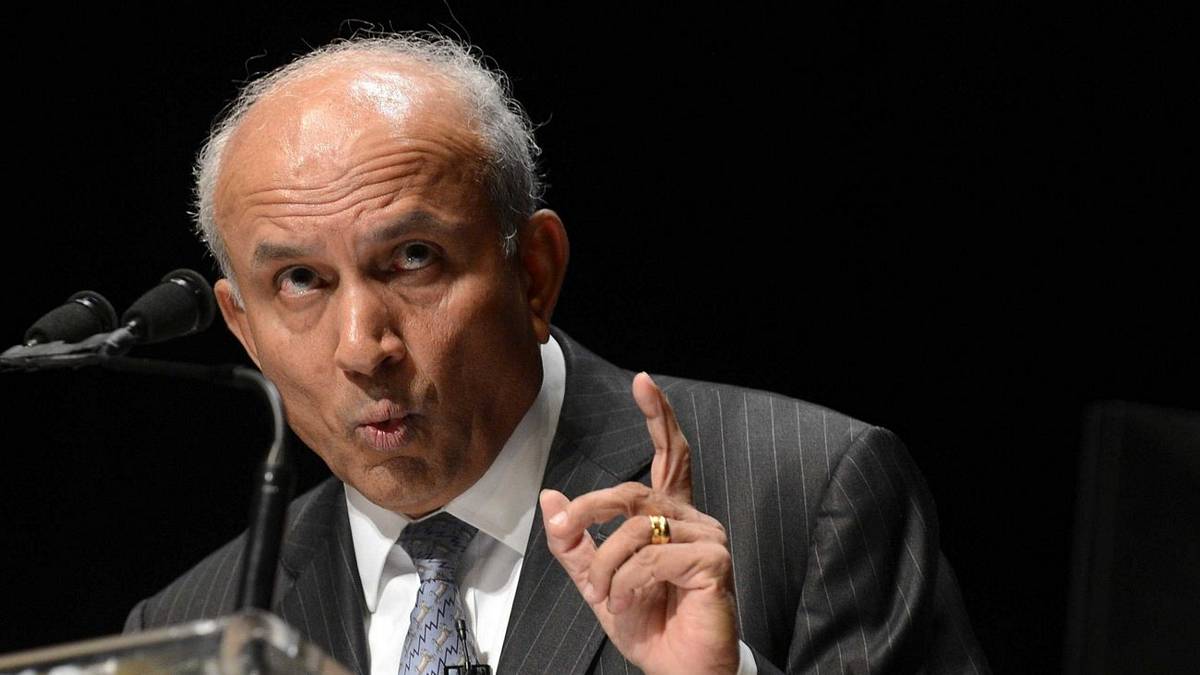

.jpg) From ‘Charlie Munger: The Complete Investor’ by Tren Griffin

From ‘Charlie Munger: The Complete Investor’ by Tren Griffin

No one can know everything, but you can work to understand the big important models in each discipline at a basic level so they can collectively add value in a decision-making process. Simply put, Munger believes that people who think very broadly and understand many different models from many different disciplines make better decisions and are therefore better investors.

Multidisciplinary thinking offers a schema or a philosophical template within which thinkers can find an intellectual connectedness to decompartmentalize their approach and face the new intellectual horizons with a broader perspective. Single disciplines are too narrow a perspective regarding many phenomena.

Human thought, as it has evolved in detached disciplines, and the physical systems within which we live exhibit a level of complexity across and within systems that makes it impossible to understand the important phenomena that are affecting humans today from the perspective of any single incomplete system of thought. Thus interconnected systems and high levels of complexity yield a situation in which multidisciplinary tactics to understanding and problem solving produce the real growth industry in the next generation of scholarly thought.

Disciplines develop their own internal ways of looking at the phenomena that interest them. Become broadly knowledgeable about any particular phenomenon as possible before constructing theories and asserting truth assertions. Problems arise from the lack of a viewpoint from which one can understand the relationship between various disciplines.

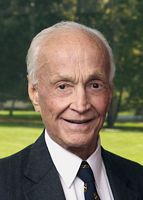

.jpg) In ‘Conceptual Foundations for Multidisciplinary Thinking’, Stanford’s Prof. Stephen Jay Kline expounds the necessity of multidisciplinary discourse:

In ‘Conceptual Foundations for Multidisciplinary Thinking’, Stanford’s Prof. Stephen Jay Kline expounds the necessity of multidisciplinary discourse:

Multidisciplinary discourse is more than just important. We can have a complete intellectual system, one that covers all the necessary territory, only if we add multidisciplinary discourse to the knowledge within the disciplines. This is true not only in principle but also for strong pragmatic reasons. This will assure the safety of our more global ideas.

Producing and applying knowledge no longer work within strict disciplinary boundaries. New dimensions of intricacy, scale, and uncertainty in technical problems put them beyond the reach of one-thought disciplines. Advances with the most impact are born at the frontiers of more than one engineering discipline.

Multidisciplinarity refers more to the internalization of knowledge. This happens when abstract associations are developed using an outlook in one discipline to transform a perspective in another or research techniques developed in one elaborate a theoretic framework in another.

To get the most out of their R&D workforce, many organizations seek persons who comprehend a range of science and engineering principles and procedures to guarantee that work will be advanced even if a specific expert were not always available.

.jpg)

.jpg)

In the

In the .jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

6:00 PM to 9:00 PM:

6:00 PM to 9:00 PM:

7:30 AM to 4:15 PM: Shop for products from

7:30 AM to 4:15 PM: Shop for products from

Meeting credentials are required to enter the CenturyLink Center for the Berkshire Hathaway meeting or the adjoining area to hit the stores of the many Berkshire subsidiaries. Meeting credentials are also required to get special shareholder pricing at Borsheims, Nebraska Furniture Mart, and other stores that might offer shareholder discounts.

Meeting credentials are required to enter the CenturyLink Center for the Berkshire Hathaway meeting or the adjoining area to hit the stores of the many Berkshire subsidiaries. Meeting credentials are also required to get special shareholder pricing at Borsheims, Nebraska Furniture Mart, and other stores that might offer shareholder discounts..jpg)